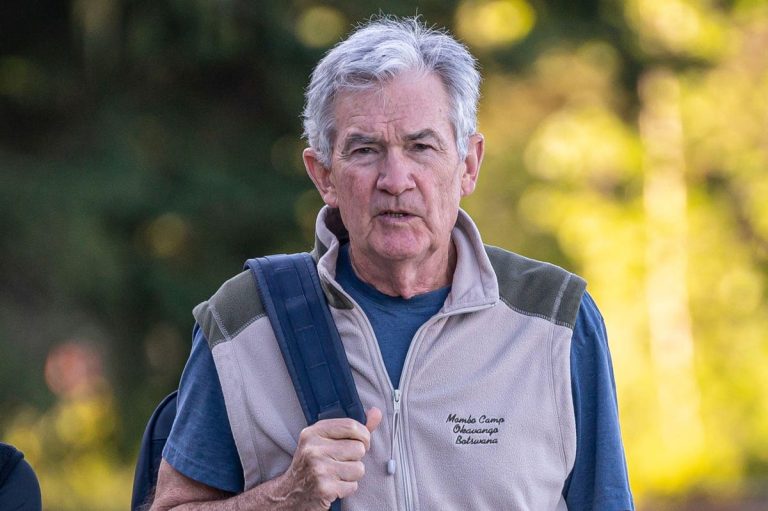

Federal Reserve Chair Jerome Powell’s speech on August 25 suggested interest rates are likely to remain high for some time. Perhaps a greater concern for markets is that Powell’s assessment that either economic growth needs to slow, notably with regard to subdued home prices and softening wage growth, or interest rates might need to rise further to stamp out residual inflation. If home prices rebound or wage growth doesn’t slow, we could see further interest rate hikes, perhaps in the next two months.

That said, Powell saw some positive inflation trends, these just haven’t been sustained enough to call inflation beaten. Still, consistent with other speeches from the Fed Chair, it was not a particularly optimistic outlook.

The Verdict On Inflation

In breaking down inflation trends, Powell sees the prices for physically goods, such as cars, trending favorably and helping bring inflation lower. Housing too is likely to see easing prices in Powell’s view. That’s because the Fed looks at lease costs, which move with a lag to home prices, so there are some disinflationary trends in the pipeline. There’s an expectation that recent declines in home prices may take time to work into the inflation data.

However, despite broadly positive trends in these two categories, Powell remains concerned about services inflation fueled by wage growth. He noted that “wage growth across a range of measures continues to slow, albeit gradually”. Inflation is not moving down as fast as Powell would like, and that’s why Powell is not hinting at interest rates cuts, and still signals higher rates, though perhaps describing interest rate hikes in a more data-dependent way than previously.

What Could Cause Rates To Rise

Powell signaled two factors that could prompt higher interest rates. The first is housing, if “the housing sector is showing signs of picking back up”, as may have been the case recently, then the Fed may be tempted to raise rates.

Secondly, regarding the labor market, “evidence that the tightness in the labor market is no longer easing could also call for a monetary policy response.”

However, the resulting setup for monetary policy is unlikely to be positive for markets. Either the Fed sees weakness in the housing market and a softening labor market, or it considers increasing rates further. This implies that the U.S. economy may see either economic weakness or higher rates, if Powell’s assessment holds. That’s a choice between two potentially bad outcomes. Better than expected economic data could mean higher interest rates, and weak economic data clearly brings its own problems.

The Outlook For Interest Rates

Still, there were some grounds for a little optimism. Powell is no longer signalling that rates will definitely move higher in 2023. Rather he is outlining certain scenarios under which interest rates could increase. Notably, if home prices rebound or if wage growth grows again.

Similar to the Fed, fixed income markets too are unsure how this will play out. Currently, according to the CME’s Fedwatch Tool there’s roughly a 50/50 chance that rates rise one more time in 2023 at either the September or November meeting. Markets remain a little more optimistic on lower rates than the Fed’s recent assessments.

Much will depend on upcoming inflation data. Importantly, Powell stated that, “two months of good data are only the beginning of what it will take to build confidence that inflation is moving down sustainably toward our goal.” That’s really the key, the Fed is starting to see some encouraging data, but needs to see more of it.

Overall, the worry for markets is that Powell is essentially looking for weakening economic data or signalling further interest rate hikes could be on the cards. Neither option would be well received.

The optimal path for the economy may be one where growth is soft enough to bring inflation lower, but not so weak that it leads to a painful recession. It’s unclear if that’s we’ll get, but the economy and especially the labor market has defied many forecasts over recent years. Powell’s final caveat was testament to this stating, “we are navigating by the stars under cloudy skies”.

Read the full article here