Participating in a money challenge is a great way to bolster your savings account. However, the popular 52-Week Savings Challenge can be intimidating, mainly because some of the weekly amounts can feel pretty high when you look at them on a chart. But, by breaking it down and starting small, you can accomplish the same thing without some of the stress. All you need to do is take it one nickel at a time.

The Origin of the 365 Day Money Challenge

Back in 2014, we decided to look for ways to make the 52-Week Savings Challenge a bit more accessible. Instead of large weekly deposits, participants only need to focus on small amounts each day.

This approach made the 365 Day Money Challenge a massive hit, especially since it’s relatively simple to adjust. If you want to save up more than $3,300 in a year, complete the challenge with nickels. If you don’t have that much to spare, you can use pennies and still save about $668.

How the Money Challenge Works

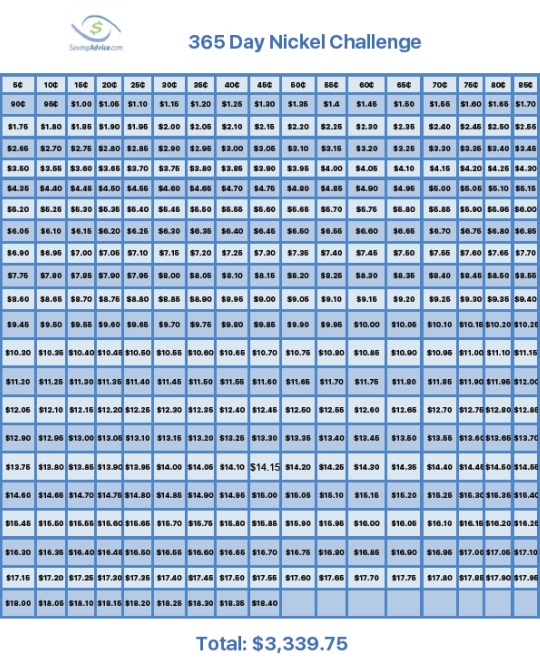

The premise of the 365 Day Money Challenge is simple. If you are using nickels, on day one you deposit $0.05 into your savings account. Then, you add $0.05 to your deposit on day two, making that deposit worth $0.10, bringing your total savings to $0.15.

On each subsequent day, you add a nickel to the previous day’s deposit. That means, on day 10, you deposit $0.50. On day 100, your deposit is $5.00. On the last day, number 365, your deposit is $18.40.

While the daily amounts seem small, they add up fast. At the end of the year, if you participate every single day, you’ll have a whopping $3,339.75 in your savings.

What Could You Do with $3,300?

Think about what you could do with over $3,300 each year. You could replace your living room furniture, buy a high-end computer, head out on a great vacation, or simply make Christmas shopping incredibly affordable.

Using the challenge to create or build your emergency fund is also a great decision. Similarly, $3,300 is a nice down payment on a vehicle or could make saving 20 percent down for the purchase of a home easier to manage.

If you want to help your child pay for college, $3,300 a year for a full 18 years is $59,400, not including interest. If you put the money into a 529 plan, the value will be much higher when it is time for your child to head to school.

Make It a Family Affair

While saving using the nickel strategy might be too much for your children, many kids can use the same plan and substitute pennies for nickels. With this approach, the largest deposit is just $3.65, which can be more manageable for youngsters. But, they still get to save up a decent amount of cash, having around $668 when the challenge is over.

If you want to instill good savings habits in your children, consider having them start with the penny challenge or another money challenge for kids. Then, as they get older, they can transition to the nickel challenge.

Additionally, there is nothing to say that you can’t increase the level of challenge yourself. If your income can support it, consider using dimes or quarters instead of nickels. You’ll be happy you did.

Coming Up With The Money For The 365 Day Challenge

Obviously, a good sources of nickels for the money challenge is your job. However, if your salary is spoken for, here are some good options for coming up with the small amounts of money you need on a daily basis.

- Taking Surveys. Most survey apps are terrible in terms of the time you invest for the financial returns for the time you spend. However, there are a couple of good survey apps that can pay reliably and well. These are 1Q and Prolific. 1Q Stands for 1 Question. It pays 25 cents per question you answer, and sends your money to your PayPal account immediately after you complete the survey. Prolific is a great marketplace for short surveys. Most of the surveys in prolific pay about 20 British pence (easily convertible to dollars on Paypal) and you can do as many surveys as you want.

- Sell Your Spare Internet Bandwidth. If you have an unlimited internet plan you probably have gigabytes on your plan you are not using. Did you know you can sell this? How this works is marketing companies pay you to install an app on your computer. In return for install the app, the company will pay you between 1 and 10 cents per gigabyte. The two reputable ones in this space are EarnApp and Honeygain. EarnApp pays you automatically once you hit $2.50 in your account via Paypal. Honeygain also pays you via Paypal. Both are reliable and legitimate.

- Use Cashback Sites. Websites like Rakuten, Ibotta and BeFrugal are excellent ways to shave off a couple of percentage points on anything you buy. They’re especially good for electronics, food and clothing. Usually what you do is open an account with the cashback site, and shop through the cashback site. The retailer will send the site a commission, which splits it with you.

- Use Coupons And Save The Difference. There is no reason to pay full price for anything – as there are pretty much coupons for everything. This includes groceries, household durables and the like. If you shop hard, you can also find cashback deals or coupons or just about anything, including cars, appliances, or anything else. Then take the cash back and put it towards the money challenge.

Do you have a favorite money challenge? Share it in the comments below.

Read More From Around The Web:

- Alternatives to the 52 Week Money Challenge

- Save Nearly $500 with the 30 Day Money Challenge

- Try the No Spending Challenge

- 23 Crazy Ways People Save Money

- Crazy Ways To Save Money from A Modern Homestead

- 17 Unusually Weird Ways Tips For Saving Money

- 60 Weird and Creative Ways To Save Money

Read the full article here