I have received several requests from readers asking if there is a better way to do the 52 week money challenge if you are paid on a bi-weekly basis. They mentioned that it tends to be easier to save the money for the week when they get paid, but more difficult to do it the second week when no income is coming in. Those who are paid bi-weekly may want to follow this bi-weekly money challenge chart.

Before we talk about how to take the bi-weekly challenge, it makes sense to pause and consider why you need a healthy savings. Having a full savings account reduces your stress and it allows you to take advantage of investing opportunities as they arise.

Another overlooked but important benefit is a healthy savings account keeps you from making bad decisions. Unexpected things such as traffic accidents, illness, or job losses happen. If your savings account is full, you won’t be forced to borrow when something happens. This means you avoid interest, penalties and fees.

So, here how to do the bi-weekly money challenge.

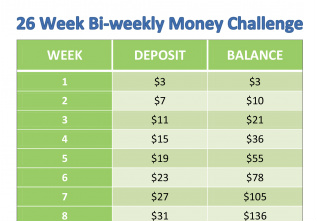

26 Bi-Weekly Money Challenge (click on image to print)

The concept is the same as the 52-week money challenge, where you’re adding a single dollar for each week of the year. The only difference is that instead of making the payment each week, you combine two weekly payments into one, and make it every other week. There is no difference in the amount of money you save.

At the end of the year, you’ll still have saved $1,378. The only difference is, you’ll be making 26 payments during the year, corresponding to your paychecks, which should make the challenge easier to accomplish. In some months you may have more than two checks. So you have a little bit of flexibility if you miss a week.

With the standard 26 week version, you would make a payment of $3 ($1 for week one and $2 for week two) for the first bi-weekly payment, $7 ($3 for week three and $4 for week four) for the second bi-weekly payment, and $11 ($5 for week five and $6 for week six) for the third bi-weekly payment, until you reach the 26th payment which would be $103 ($51 for week fifty-one and $52 for week fifty-two). While straightforward and simple, there is a major drawback. As with the standard 52-week version, this can make it difficult to save money toward the end of the year with the high payments during the holiday season. This is why we created an alternate version of the money challenge.

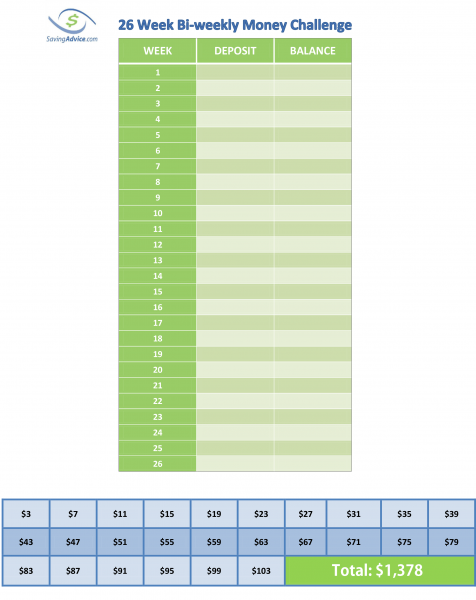

Alternate Version (click on image to print)

The alternative version gives you more flexibility while still sticking with the 26 bi-weekly option. With this version, you still make the same payments throughout the year, but you get to choose which one you make for each bi-weekly payment. The goal is to pay the highest amount from the options at the bottom of the chart, then cross out that number. That allows you to pay off the higher amounts when it makes the most sense as the year progresses, rather than at the end of the year when money might be the tightest. This version takes into account that a steady increase in payments over the year doesn’t always correspond with the reality of life. For that reason, it’s nice to have some flexibility in the amount when making the payment.

The alternative version gives you more flexibility while still sticking with the 26 bi-weekly option. With this version, you still make the same payments throughout the year, but you get to choose which one you make for each bi-weekly payment. The goal is to pay the highest amount from the options at the bottom of the chart, then cross out that number. That allows you to pay off the higher amounts when it makes the most sense as the year progresses, rather than at the end of the year when money might be the tightest. This version takes into account that a steady increase in payments over the year doesn’t always correspond with the reality of life. For that reason, it’s nice to have some flexibility in the amount when making the payment.

As with most things that pertain to finances, it’s important to find the best savings method for you. The 26 week bi-weekly money challenge is simply another variation that might make it a little easier to save than the standard 52 week money challenge. It’s certainly an option worth considering if you are paid on a bi-weekly basis, and you know you’ll find yourself short on funds when it’s time for the next paycheck to arrive. As with all savings plans, they tend to be much more effective if you pay yourself first rather than at the end when there often isn’t any money left to save.

Finding Money For The Bi-Weekly Savings Challenge

If you’re in a situation where you’re short of cash to save, there is good news. The internet is awash with money. You just need to figure out how to get some. There are a number of good lists of ways to make extra money floating around the web. Since you don’t need to come up with a huge amount of cash on a weekly basis, some side activities might help you raise the weekly cash you need.

- Do Surveys. Surveys are usually offer a low return for your time. However, there are a couple of strategies that might help you raise some extra money. You can take a couple of good paying, longer surveys per week. The best place to find these is your local research hospital. Alternatively you can try prolific.com or 1Q. 1Q is good – it pays 25 cents per question, which is significantly better than the competition.

- Ask For A Raise. For most people, the most efficient way to get extra money is to get paid more for what you are doing at your day job. Getting your employer to give you 1% or 2% percent more may not be too hard, especially if you are doing a good job.

- Sell Your Browsing History. Most people are afraid of doing this, but the reality is that big tech is already tracking you. Why not flip the tables and get paid? There are two good companies that will help you with this. First, Nielsen Opinion Rewards (the digital version of the old Nielsen rating system), will reliably pay you $5 a month. Another good company is Savvy Connect – which also pays $5 per month.

- Sell Your Spare Internet Bandwidth. So, this is crazy, but it works. Market researchers will pay you by the gigabyte to use your spare internet cycles. There are two reputable companies in this space; EarnApp and Honeygain. I use both and find they don’t impact my computer or network performance that much.

If you don’t like these ideas, here are some other lists that might help.

The College Investor has a list of 53 popular side hustles, and theonehourprofessor.com has a eleven strange but profitable side hustle ideas. Finally, buildapreneur.com has a helpful list of 97 insanely lucrative side hustles.

Finally, if you’re still looking for the right money challenge to fit your personality, here are other variations of money challenges that might be worth taking a look at:

Earn More with the 52 Week Make Money Challenge

52 Week Kids Money Challenge

Printable Monthly Money Chart

365 Day Money Challenge

If you liked this article, please rate it 5 stars below, leave us a comment or share it on social media!

Read the full article here