Business tax break becomes permanent

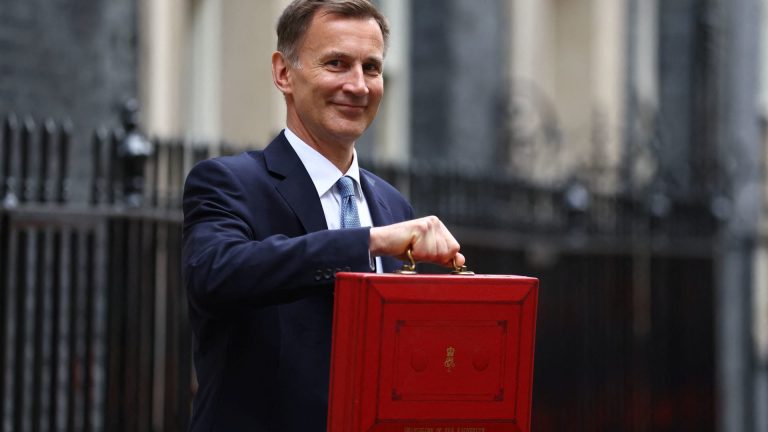

Hunt confirms that the “full expensing” tax break for businesses will become permanent.

Businesses can claim back 25 pence in corporation tax for every £1 they invest in IT, machinery and equipment, a measure that will cost the Treasury £11 billion a year. Hunt said it represents the “largest business tax cut in modern British history.”

Hunt confirms £4.5 billion for British manufacturing

Hunt confirms the pre-announced £4.5 billion in funding for British manufacturing to boost investment in eight sectors across the U.K., available for a five-year period from 2025.

Announced by the Treasury last week, this includes £960 million for clean energy, over £2 billion for the automotive industry, £975 million for aerospace and £520 million for life sciences manufacturing.

The entire manufacturing sector makes up over 43% of all U.K. exports and employs around 2.6 million people, and Finance Minister Jeremy Hunt said the government was targeting funding to “support the sectors where the U.K. is or could be world-leading.”

“Our £4.5 billion of funding will leverage many times that from the private sector, and in turn will grow our economy, creating more skilled, higher-paid jobs in new industries that will be built to last,” Hunt said in a statement.

– Elliot Smith

Hunt: Government to invest £500 million in AI

Hunt promises an additional £500 million investment in artificial intelligence.

“When it comes to tech, we know that AI will be at the heart of any future growth. I want to make sure our universities, scientists and startups can access the compute power they need,” he says.

“So building on the success of the supercomputing centers in Edinburgh and Bristol, I’ll invest £500 million over the next two years to fund further innovation centers to help make us an AI powerhouse.”

UK economy forecast to grow by 0.6% this year and 0.7% next year

The OBR forecasts that the U.K. economy will grow by 0.6% this year and 0.7% next year, Hunt reveals.

GDP is then set to expand by 1.4% in 2025, 1.9% in 2026 and 2% in 2027.

This marks a sharp downgrade for 2024 and 2025, where growth was projected at 1.8% and 2.5%, respectively, in the OBR’s spring forecasts.

Alcohol duty frozen, tobacco duty to rise

Alcohol duty will be frozen until August 1, 2024, Hunt confirms, while duty on hand-rolling tobacco will rise by an additional 10%.

UK needs a ‘more productive state, not a bigger state’: Hunt

Hunt says the U.K. needs a “more productive state, not a bigger state,” setting a new public sector productivity growth target of 0.5% per year.

This follows an existing plan to cut the size of the civil service to pre-pandemic levels, as part of measures to ensure public sector spending growth “is always lower than growth in the economy,” Hunt says.

UK government’s policy on inflation reduction is not enough: City of London Corporation

Chris Hayward, policy chairman at the City of London Corporation, gives his take on the inflationary risk of the U.K. government’s new fiscal policies, how to rebuild “broken trust” with the EU, and why he sees Labour as a “pro-business party.”

Government will meet 2% of GDP defense spending, Hunt says

Hunt says the U.K. will meet its NATO commitment to spend 2% of GDP on defense, which he says is “critical at a time of global threats to the international order, most notably from Putin’s evil war in Ukraine.”

Hunt: Public sector borrowing set to fall from 4.5% this year to 1.1% in 2028/9

According to the OBR, borrowing is lower this year and next, and on average across the forecast, by £0.7 billion every year compared to the spring forecast, Hunt says.

Government borrowing falls from 4.5% of GDP in 2023/4 to 3% next year, 2.7% in 2025/6, 2.3% in 2026/7, 1.6% in 2027/8 and 1.1% in 2028/9.

“That also means we meet our second fiscal rule, that public sector borrowing must be below 3% of GDP not just by the final year, but in almost every year of the forecast,” Hunt says.

“Some of this improvement is from higher tax receipts from a stronger economy, but we also maintain a disciplined approach to public spending.”

Hunt: Debt falling as a percentage of GDP

According to the OBR, underlying debt is now forecast at 91.6% next year, 92.7% in 2024/5 and 93.2% in 2026/7 before declining in the final two years of the forecast to 92.8% in 2028/9.

“That is lower in every year compared to forecasts in the spring. We therefore meet our fiscal rule to have underlying debt falling as a percentage of GDP in the final year of the forecast with double the headroom compared to the OBR’s March forecast, and we will continue to have the second-lowest government debt in the G7,” Hunt said.

Hunt: State pension to rise by 8.5%

Hunt says the full new state pension will rise by 8.5% to £221.20 per week, worth up to £900 per year for pensioners.

Including today’s measures, this takes this government’s “total commitment to easing cost of living pressures” to £104 billion, he adds.

Hunt: Universal Credit and other benefits to increase by 6.7%

Hunt says Universal Credit and other benefits will increase by 6.7%, in line with September’s annual inflation figure and amounting to an average increase of £470 for 5.5 million households next year. Universal Credit is a means-tested social security payment to low-income or unemployed households.

Local housing allowance will be increased to 30th percentile of local market rents, giving 1.6 million households an average of £800 of support next year.

OBR: Inflation to fall to 2.8% next year

The independent Office for Budget Responsibility projects inflation will fall to 2.8% before the end of 2024 and back to the Bank of England’s 2% target in 2025, Hunt says.

Resolution Foundation: Reshuffling, not cutting taxes

The Resolution Foundation, a think-tank focused on improving living standards for low and middle-income households, says the chancellor’s measures will amount to a “major tax reshuffle — adding tax cuts to the tax rises already in train.”

Resolution Foundation economists Torsten Bell, Adam Corlett and Lalitha Try said that the most likely personal tax cut will be to the basic rate of income tax, with 36 million people benefiting by an average of £200 per year from a basic rate cut by £0.01. This measure would cost the Treasury £7 billion a year, the foundation estimates.

It nevertheless noted that overall income taxes are rising, given Hunt’s previously announced tax freezes that are currently underway.

“We’re reshuffling taxes not cutting them – with most people seeing taxes go up. Why? Because big, previously announced tax rises are underway,” the Resolution Foundation said.

“If we think about the impacts of these changes next April in particular, the Income Tax and National Insurance thresholds being frozen (rather than increasing by 6.7 per cent in line with inflation) will raise £8 billion, and cost all basic rate employees £270 (and pensioners £170).”

– Elliot Smith

TUC leader: Sunak ‘stretching credibility’ in claiming credit for falling inflation

Paul Nowak, general secretary of the Trades Union Congress, told CNBC on Wednesday that Prime Minister Rishi Sunak is “stretching credibility” in trying to claim credit for inflation halving.

The headline consumer price index rose by 4.6% year on year in October, down from more than 10% in January, as falling energy prices and the Bank of England’s interest rate hikes slowed the rate of inflation.

In January, the prime minister listed halving inflation as one of his top priorities, and was quick to declare victory after last week’s CPI print. However, the country’s economic institutions had unanimously forecast that inflation would dip before 5% by the end of the year irrespective of government policy.

“A year ago, the prime minister was telling us that inflation wasn’t the fault of the government — it was global energy prices — and now he’s taking credit for bringing down inflation, so you can’t have your cake and eat it,” Nowak told CNBC’s Silvia Amaro.

“Now of course any easing of inflationary pressures is good, but those price rises are baked in, and at a time when ordinary working people haven’t seen their wages rise, the price of a supermarket shop hasn’t gone down, the price of filling up your car hasn’t gone down, rent and mortgages certainly haven’t gone down, so the prime minister I’m afraid is stretching credibility a little bit to be claiming any credit for driving down inflation and addressing the cost of living crisis.”

— Elliot Smith

UK Liberal Democrat leader: Must tackle health crisis to grow the economy

Ed Davey, leader the Liberal Democrats, says the government needs to tackle long-standing issues with the National Health Service in order to achieve its ambitions for economic growth.

A survey conducted by the party found that one in three working adults in the U.K. miss work while waiting for an appointment or treatment through the NHS, while one in five are unable to go to work while waiting to see their family doctor.

Davey told CNBC’s Silvia Amaro on Wednesday that a massive shortage of family doctors and a failure to bolster the care system means hospitals are overrun and people are forced to stay off work longer than necessary, “undermining the economy.”

“If we want our economy to grow, we really do have to tackle those sorts of problems, and the Conservatives promised at the last election to do that and they’ve failed absolutely miserably — wasted a lot of money on, for example, the PPE contracts during the pandemic, which wasted billions of pounds — so we need better spending on health but we need to tackle people’s problems,” he said.

“The Conservatives have really misunderstood the problems in our health service, and how it impacts on the economy, and I was very disturbed to hear the [Prime Minister] earlier this week actually exclude health from his top priorities. He’s completely out of touch and doesn’t understand what businesses are saying, and what people are suffering.”

– Elliot Smith

London financial center boss: Labour is now a ‘pro-business party’

Chris Hayward, policy chairman of the City of London Corporation that represents the interests of London’s financial district, told CNBC on Wednesday that a Labour government would not “frighten the horses” as far as business is concerned.

Polls suggest that the U.K.’s main opposition Labour Party could be on course to take power with a substantial majority at the next General Election, which must be held before the end of January 2025.

“We in the City Corporation are non-party political — we work with politicians across the board and whichever government that we get given — but I think Labour has changed dramatically since the last General Election,” he said.

Labour lost the 2019 election in a landslide under its hard-left former leader Jeremy Corbyn, but current leader Keir Starmer has sought to rebuild the party as a centrist, moderate alternative to a ruling Conservative Party, widely seen as lurching to the right in recent years.

“They now are a pro-business party and for us in the City, that is of fundamental importance. We need a government that understands that driving business growth will actually drive tax receipts, which in turn will drive spending on public services,” Hayward said.

“I think this would be a government that wouldn’t frighten the horses as far as businesses are concerned in the City.”

– Elliot Smith

Conservative peer Harrington: Don’t expect ‘anything dramatic’ on personal tax cuts

Conservative peer Richard Harrington told CNBC on Wednesday that Finance Minister Jeremy Hunt has been listening to businesses and will move to make the business tax regime more accommodative.

“I’m sure the regime will be moving towards the kind of investment breaks and such like that business is looking for, given the financial constraints the chancellor has got,” Harrington, who sits in the House of Lords, told CNBC’s Silvia Amaro outside Parliament.

However, he suggested that measures to put more money in people’s pockets at the end of the month are likely to be more muted.

“The pre-trailed announcements about National Insurance and such like, I’m sure will help towards that, but of course everybody knows the country’s public finances were in an absolute dire state,” he said.

“The things that Rishi Sunak and Jeremy Hunt have done will help towards bettering that, but it’s not instant, and so I do not expect anything dramatic on the retail tax cut side.”

– Elliot Smith

Treasury minister confirms incoming personal tax cuts

Laura Trott, a minister in Hunt’s Treasury, told BBC News on Tuesday that the finance minister will announce cuts to personal taxes on Wednesday as the economic outlook has “completely changed.”

“The economy is in a very different place to where we were a year ago. We can now focus on going for growth, pushing up the growth rate of the economy and cutting taxes for individuals.”

Prime Minister Rishi Sunak’s government will be keen to offer some positive news to voters, who have been hammered by high inflation and sluggish growth in recent years, ahead of a likely general election in 2024. The main opposition Labour Party currently holds commanding leads in the polls.

– Elliot Smith

National Living Wage increased to £11.44 per hour

Hunt will announce an increase to the National Living Wage of more than £1,800 ($2,253.78) per year for a full-time worker, and extend the threshold to cover 21-year-olds for the first time.

The increase of almost 10% will take hourly pay to £11.44 an hour, while National Minimum wage rates for younger workers will also rise, with 18-20-year-olds receiving an hourly boost of £1.11 to take the minimum wage to £8.60 per hour.

The Department for Business and Trade estimates 2.7 million workers will directly benefit from the National Living Wage increase.

– Elliot Smith

Cuts to National Insurance and business tax, tougher benefit sanctions expected

Hunt is set to announce a cut to National Insurance contributions for millions of workers on Wednesday, along with a reduction in business taxation and tougher treatment of benefits claimants, multiple British news outlets reported Tuesday.

The BBC reported that Hunt will announce measures to boost business investment by £20 billion ($25.04 billion) per year in a bid to “get Britain growing.”

The government has also pre-announced plans to withdraw support for benefit claimants who fail to find work after 18 months, unless they undertake a work experience placement.

– Elliot Smith

Berenberg: ‘Too many problems, too little time’

Sticky global inflation and domestic supply-side challenges mean the government is unlikely to break from the cautious approach seen over the past year, according to Berenberg Senior Economist Kallum Pickering, who said Hunt faces “too many problems, too little time.”

Despite the suggestion of incoming tax cuts on Wednesday, Pickering said Hunt will struggle to announce policies that could “materially improve the near-term economic outlook,” and will likely focus on reducing the deficit and debt as a percentage of GDP.

“Any large and immediate debt-financed tax cuts or spending increases would likely stoke fresh inflation worries and a renewed spike in government borrowing costs, rather than boosting growth hopes,” Pickering said in an email Tuesday.

“Looking further out, Hunt may set out plans to cut taxes more quickly from 2026 onwards once inflation risks have further subsided.”

However, he noted that any such delayed tax plans would only be implemented after the country’s next General Election, due before the end of January 2025 but likely to be called late next year.

With the main opposition Labour Party holding a commanding lead in the polls, any forward-looking tax changes announced on Wednesday may never materialize.

– Elliot Smith

IFS director: ‘Dozens’ of better options than cutting inheritance tax

Speculation has abounded in the British press in recent days that Hunt could be set to announce a cut to the U.K.’s inheritance tax.

Inheritance tax is a 40% levy on the value of the estate of someone who dies, including their property, money and possessions, exceeding the minimum threshold of £325,000. The tax is only charged on the excess above the threshold, and only around 4% of estates in the U.K. are subject to it.

“There are dozens of tax cuts that would be some combination of more equitable and better designed to promote economic efficiency and growth,” said Paul Johnson, director of the Institute for Fiscal Studies.

“We are in the middle of a record-breaking increase in the tax burden on income and earnings. Effective tax rates on wealth have been falling for decades. A cut in the tax on inherited wealth looks particularly ill-timed.”

The IFS estimates that the rumored cuts would raise a “relatively paltry” £7 billion per year, and about half the total is paid by the 1% of estates valued at more than £2 million.

“As you’d expect, the beneficiaries of bequests big enough for inheritance tax to be paid are much more likely themselves to have high earnings and high levels of wealth than the average: those from better-off backgrounds earn more and accumulate more wealth even before they benefit from any inheritance,” Johnson explained.

– Elliot Smith

Hunt confirms £4.5 billion for British manufacturing

Hunt confirms the pre-announced £4.5 billion in funding for British manufacturing to boost investment in eight sectors across the U.K., available for a five-year period from 2025.

Announced by the Treasury last week, this includes £960 million for clean energy, over £2 billion for the automotive industry, £975 million for aerospace and £520 million for life sciences manufacturing.

The entire manufacturing sector makes up over 43% of all U.K. exports and employs around 2.6 million people, and Finance Minister Jeremy Hunt said the government was targeting funding to “support the sectors where the U.K. is or could be world-leading.”

“Our £4.5 billion of funding will leverage many times that from the private sector, and in turn will grow our economy, creating more skilled, higher-paid jobs in new industries that will be built to last,” Hunt said in a statement.

– Elliot Smith

Read the full article here