On average, American households have approximately $5,300 in liquid savings. However, after the COVID Pandemic, many people don’t have a basic emergency fund socked away, and plenty of others would like to boost their savings for financial security.

With as many as 64% of Americans living paycheck to paycheck, many ask how can I actually start saving? That’s where the 365-day nickel challenge comes in. Unlike other challenges, the 365-day nickel challenge makes saving easy and rewarding.

Where the 365-Day Money Challenge Came from

The 52-week savings challenge concept has been around for a long time. However, some of the versions aren’t very accessible. They focus on making large weekly deposits, and some of them are budget-busters for an average household. Saving shouldn’t put significant financial strain on you and your family and should feel within reach.

This 365-day money challenge is meant to be a simple and attainable answer to saving. Instead of large weekly deposits, it concentrates on small daily targets. Plus, it’s incredibly adaptable. If you do the challenge with nickels, you can set aside over $3,300 in a year. If you can’t afford that, do it with pennies, and you’ll still sock away around $668. It’s important to look at your budget and determine what feels comfortable for you.

How The 365-Day Nickel Challenge Works

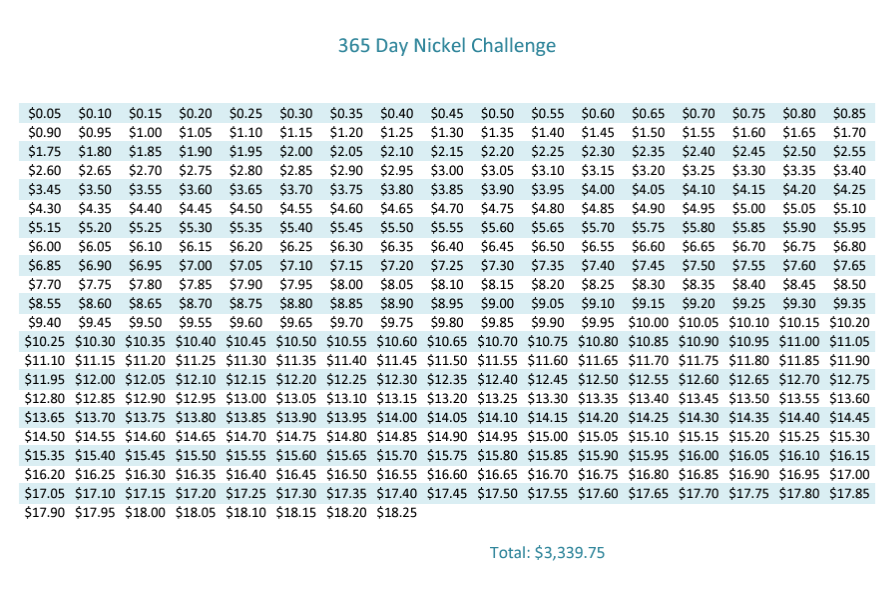

The premise behind the 365-day money challenge is incredibly simple. You start with a small initial deposit. In this case, that’s a nickel, or $0.05.

On day two, you add a nickel to the size of your deposit. That means you’ll stash away $0.10 on day two, bringing your total savings account balance to $0.15.

Each day, you increase the size of your deposit by $0.05. By day 100, you’ll be depositing $5.00. On day 200, your deposit is $10.00. Your final deposit at the end of the year would be $18.40 on day 365.

At the end of a 365-day year, you’d save $3,339.75 during the challenge. On leap years, that total goes up to $3,358.20. Plus, that’s purely in deposits. If you are earning interest, your total could be higher.

One of the biggest benefits is the daily deposits. You get to watch your savings balance rise every single day. For some, that is incredibly motivating. Seeing the results of your hard work is something you’re doing daily, and that may make it easier to stay focused.

Additionally, if you use the daily deposit approach and have an interest-earning account, you are making sure your money grows as much as possible, too. You’ll make sure that compound interest is working for you as hard as it can, increasing the value of your account even faster than it otherwise would.

What Could You Do with Over $3,300?

Another benefit of this challenge is that you can use the money in any way that makes sense. You could send it to an IRA to fund your retirement, spend the money on a major purchase like furniture or a gaming computer, or have an amazing vacation.

For many people, $3,300 would make a solid down payment on a car. If you’re working toward buying a house, $3,300 could get you well on your way toward a 20 percent down payment. If you keep it in savings, you have an emergency cushion for unexpected expenses.

Parents may even want to use the challenge to fund a child’s college. Over the course of 18 years, it’s possible to set aside about $59,400, and that’s before earning any interest. If you place that in a high-yield saving, investment, or 529 account, that money could grow into a much larger balance before your kid heads off to college.

No matter what your goal is, keep it at the top of your mind during the challenge to motivate you to stick with it. Visualizing all the financial progress you’ll be able to make with the money will help you resist the temptation to order takeout or shop online.

How To Adjust Your Budget for The Challenge

Although the 365-day nickel challenge starts off slow, you’ll eventually have to make larger deposits to save $3,300 in a year. So it’s important to figure out how you’re going to adjust your budget along the way so you can save the suggested daily amounts. If you broke down the $3,300 savings goal into equal monthly increments, you’d have to save about $275 per month, so start thinking about how you can cut that much money from your regular budget.

Are there any streaming services you could cancel this year to help you achieve your goal? Could you start cooking at home more often and shop for groceries at cheaper discount stores? Maybe you could carpool to work with coworkers to save on gas or downgrade your phone and internet plans. Brainstorm ideas on how to save money and try out different strategies to see what works best for your family.

If your budget is already pretty minimal, there may not be many costs you can cut. In that case, it could help to pick up some extra hours at work or start a side hustle. Freelance work such as writing articles and designing websites is flexible and easy to fit around other responsibilities. Gig apps like Uber and DoorDash can also help you earn some extra cash whenever you have a few hours to spare.

Making The 365-Day Nickel Challenge Accessible To Children

Making saving a family affair is always a good idea. Many children aren’t taught good savings habits, but this 365-day challenge could make the process easy.

If you are going to have your kids take part, consider making their version a penny-based challenge. The largest deposit would usually be $3.65 ($3.66 on leap years), so it will feel more manageable. Plus, in the end, they have about $668.

Children love to work towards a reward, so make sure to set that up at the beginning of the challenge. This might mean letting your child buy a new toy at the end of the challenge or take up a new hobby. Visual aids of how much they’ve saved and how close they are to their goal can also be beneficial and keep them engaged.

What To Do If You Fall Off Track

Life can sometimes throw us unexpected curveballs. The good news is that with these small deposits, it can be easy to catch up if you have an unexpected or emergency expense. If you do get off track, don’t be discouraged. The important thing is to continue to save as much as possible.

You can always extend the challenge by a few weeks or even months if you need to. The goal of the 365-day nickel challenge is simply to get into the habit of regularly saving money, which is a skill that will benefit you long after the year is over.

Bumping Up The Challenge Level

For some households, using nickels isn’t challenging enough or may not meet your financial goals. Maybe you are close to retirement or college is not too far off for your children. If you fall into that category, you can always make it more difficult by using a larger currency, like dimes or quarters.

With dimes, your largest deposit would be $36.50 (or $36.60 on leap years) while, for quarters, it would come in at $91.25 ($91.50). It’s a great option if you have room in your budget and want to save aggressively.

Exploring Tech-Based Alternatives

If you don’t want to move the money manually, there are money-saving apps that can accomplish a similar goal without as much oversight. For example, Digit analyzes your spending first and then automatically saves a small amount each day when it’s appropriate.

There are other options as well, such as purchase price roundup programs at banks, as well as many other savings-oriented apps that use a different approach. One very popular app is Acorns. You can choose to round up your purchases and make weekly deposits. The app also allows you to choose how aggressively you want to invest your portfolio.

Tech alternatives can be ideal for those who want to automate their savings, ensuring they can reach their goals without having to think too much about it along the way. Many tech alternatives also offer rewards for signing up that help you jumpstart your savings.

Have you tried the nickel challenge? Do you think it could help you save? Share your thoughts in the comments below.

Read More:

- $1 a Day Savings Challenge

- 10 Great Alternatives to the Classic 52 Week Money Challenge

- Save Nearly $500 with the 30 Day Money Challenge

Come back to what you love! Dollardig.com is the most reliable cash-back site on the web. Just sign up, click, shop, and get full cashback!

Read the full article here