LONDON — The U.K. government should not introduce further tax cuts this year, the International Monetary Fund said Tuesday, as its chief economist argued the national budget needed the money for public services and growth-friendly investments.

“What we are seeing in the U.K. and a number of other countries is a need to put in place medium-term fiscal plans that will accommodate a significant increase in spending pressures,” Pierre-Olivier Gourinchas said during a press briefing.

In the U.K., he said, this included spending on the National Health Service, social care, education and the climate transition, as well as measures to boost growth, while preventing debt levels from increasing.

“In that context, we would advise against further discretionary tax cuts, as envisioned or discussed now,” he said.

An IMF spokesperson separately said the U.K. had higher spending needs across public services and investments than were currently reflected in the government’s budget plans. The IMF has recommended the U.K. strengthens taxes on carbon emissions and property, eliminates loopholes in wealth and income taxation, and reforms rules which set pension levels.

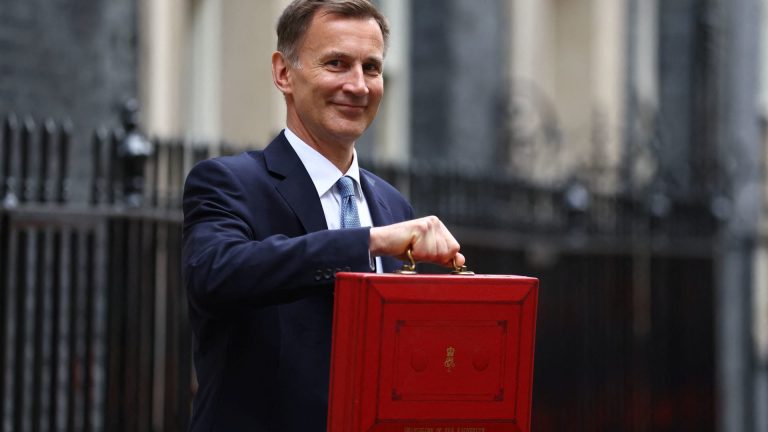

British Finance Minister Jeremy Hunt will announce his latest budget in early March, in what may be the last major fiscal announcement before a General Election is held. The timing of the vote is uncertain, but it must be called by the Conservative government at some point this year.

The Conservatives face an uphill battle, with the opposition Labour party ahead in most polls.

Hunt announced several tax cuts in his fall budget, and made several suggestions he wants to introduce more in the spring.

U.K. public sector net borrowing has fallen sharply, and in December 2023 was around half that of the prior year due to higher VAT (a sales levy) and income tax receipts and lower spending.

The IMF on Tuesday forecast 0.6% growth for the U.K. economy this year, up slightly from an estimated 0.5% figure for 2023. It revised its forecast for 2025 lower by 0.4 percentage points, to 1.6%, when it said disinflation will ease financial conditionals and allow real incomes to recover.

The downgrade, it said, “reflects reduced scope for growth to catch up in light of recent upward statistical revisions to the level of output through the pandemic period.”

Gourinchas told CNBC on Tuesday that despite a weak growth outlook for the year, the U.K. had seen positive news on inflation, which is forecast to average 2.8%.

“We’re at that point, we think, that the Bank of England will be in a position like the Federal Reserve and [European Central Bank] to ease policy rates as inflation is finally brought towards target,” he said.

Read the full article here