Nvidia reported its fourth-straight quarter of triple-digit revenue growth on Wednesday, sailing past estimates on the top and bottom line while also issuing a forecast that topped Wall Street expectations. The company even bolstered its buyback program with a plan to repurchase $50 billion in shares.

But the stock dropped 7% in extended trading.

That’s life for Nvidia, which has ridden the artificial intelligence boom to a $3 trillion market cap, soaring almost nine-fold since the end of 2022 and surpassing every public company other than Apple in valuation. (It topped Apple for a stretch in June.)

In addition to reporting 122% annual revenue growth on Wednesday to over $30 billion, Nvidia said sales in the current period will jump about 80% to roughly $32.5 billion. Analysts were expecting close to $32 billion.

However, Stacy Rasgon, an analyst at Bernstein, told CNBC before the report came out that “buyside whispers” were closer to $33 billion to $34 billion, meaning Nvidia would have to dramatically surpass analyst estimates in its guidance in order to see a pop.

Rasgon, who recommends buying shares of the chipmaker, said there are no indications that demand is waning for Nvidia’s graphics processing units (GPUs), the core infrastructure for developing and running AI models.

“There’s still a ton of demand,” Rasgon said on CNBC’s “Closing Bell.” “They’re still shipping everything that they can sell.”

Nvidia said it expects to ship “several billion dollars” worth of Blackwell revenue in the fiscal third quarter, which ends in October. Blackwell is the company’s latest generation of technology, following Hopper. There had been some concerns that Blackwell would be delayed, but CFO Colette Kress said on the call with analysts that “supply and availability have improved.”

Still, “demand for Blackwell platforms is well above supply, and we expect this to continue into next year,” Kress said.

Other than missing the “whisper” numbers, some investors may be looking at Nvidia’s gross margin, which slipped a bit in the quarter to 75.1% from 78.4% in the prior period. That’s up from 43.5% two years ago and 70.1% in the fiscal second quarter of last year.

For the full year, the company said it expects its gross margin to be in the “mid-70% range.” Analysts were expecting full-year margin of 76.4%, according to StreetAccount.

‘Getting returns right away’

On the earnings call, analysts asked Nvidia executives about customers and whether they’re making money on their investment. Following the company’s prior report, Kress gave investors data points showing that a cloud provider could make $5 over four years selling access to $1 of Nvidia chips.

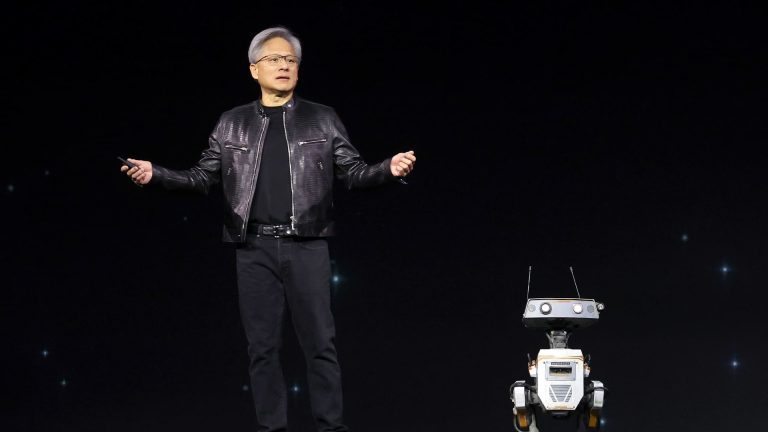

This time, Nvidia took a different approach. CEO Jensen Huang said on Wednesday’s call that Nvidia’s technology will be taking work away from traditional processors, like those made by Intel or AMD. He also said generative AI would start to do more coding, that companies like Meta can use Nvidia chips for recommender systems, and that nations are starting to buy more chips.

“The people who are investing in Nvidia infrastructure are getting returns on it right away,” Huang said.

Huang also said that next-generation AI models would require “10, 20, 40 times” more computing power, echoing comments recently made by former Google CEO Eric Schmidt.

“The frontier models are growing in quite substantial scale,” Huang said.

He said Nvidia’s main customers are vying to be first to produce new AI advancements.

“The first person to the next plateau gets to introduce a revolutionary level of AI,” Huang said. “The second person who gets there is incrementally better or about the same.”

But buying into Nvidia at these levels is a bet that the company can continue to outperform very high expectations and requires a willingness to accept the kind of stock volatility generally reserved for much smaller companies.

After reaching a record in June, Nvidia proceeded to lose almost 30% of its value over the next seven weeks, shedding roughly $800 billion in market cap. It’s since recovered most of those losses.

In the past two years, the stock has moved 5% or more in a single day on 50 separate occasions. For Microsoft, that’s happened only six times, which is one more than for Apple. At Meta, it’s happened 21 times. Tesla fans, however, can relate. Shares of the electric automaker have moved at least 5% on more than 70 trading days over that stretch.

One reason for Nvidia’s increased volatility is that it relies on a small group of customers — including those mentioned above — for an outsized amount of its revenue. Top execs at Alphabet and Meta both acknowledged recently that they could be overspending in their AI buildout, but said the risk of underinvesting was too great for them to not be aggressive.

WATCH: Nvidia’s latest report ‘basically down the middle’

Read the full article here