Entrepreneur

“Nothing is certain except death and taxes.”

This proverb, often attributed to Benjamin Franklin, has stood the test of time. But if I could add one more piece to this pearl of wisdom, it would be this: “Nothing is certain except death and taxes, but death doesn’t change; taxes are always changing.”

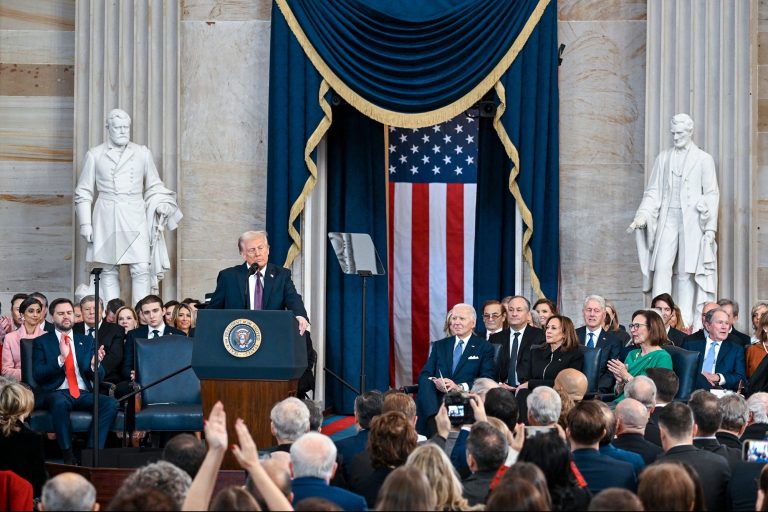

With President-elect Donald Trump’s second inauguration, entrepreneurs and investors are watching closely for those changes. In his first term, President Trump accomplished one of the most significant overhauls to the tax code in decades with the 2017 Tax Cuts and Jobs Act (TCJA). With issues surrounding the economy and job growth front and center, the next four years may bring another wave of change.

With many of the tax cuts in the TCJA set to expire at the end of 2025 absent Congressional action, at least some change is inevitable. However, how much change and what kind is much harder to predict. The current political climate means Republicans will need to drive any tax policy changes, but with a razor-thin majority in the House, any single legislator will have tremendous power.

Despite the uncertainty, there are some things entrepreneurs can likely expect.

1. The corporate tax rate is unlikely to increase

The TCJA slashed the corporate tax rate from 35% to 21% — a pro-business shift that has spurred investment in countless industries. The good news for entrepreneurs is that this change isn’t among those set to expire.

President-elect Trump has publicly floated the idea of reducing the corporate tax rate even further, potentially to 15% for companies that make their products in the U.S. Given concerns over the federal budget deficit, it’s unclear when or if such a reduction could come to pass. But the overall message on corporate taxes is clear: keeping them low is a priority.

2. Individual tax rates will stay roughly the same

While the individual income tax reductions and standard deduction in the TCJA are set to expire at the end of 2025, extending them is widely popular. In a 2023 survey by the Pew Research Center, more than half of U.S. adults said they feel they pay more than their fair share of taxes and that the tax system is frustratingly complex.

Given this public support and President-elect Trump’s advocacy for extending the TCJA, we’re most likely to see individual tax brackets remain roughly the same, and the standard deduction might even increase.

3. Big tax deductions are likely to change

The TCJA introduced or expanded a number of tax deductions that are hugely valuable to entrepreneurs. Here are three to watch:

- Qualified Business Income (QBI) deduction

This deduction allows many owners of pass-through businesses to deduct up to 20 percent of their qualified business income, plus 20 percent of qualified real estate investment trust dividends and qualified publicly traded partnership income. The deduction is available even for taxpayers who take the standard deduction, and it has been a game-changer for small business owners.

Unfortunately for many entrepreneurs who rely on this deduction, its extension may not make the cut in the upcoming tax debate; many Democrats argue it is helping the wealthy at the expense of average taxpayers, and many Republicans will prioritize reductions to the corporate tax rate over the QBI.

Bonus depreciation is a tax deduction the government uses to encourage businesses to invest in certain assets, including some equipment, software, vehicles and rental real estate. The TCJA increased bonus depreciation from 50% to 100% until 2022. Since then, it has dropped by 20 percentage points each year and is set to reach zero by 2027 without Congressional action. President-elect Trump has proposed reinstating a full 100% bonus depreciation deduction, and I expect the new Congress to support this for manufacturing and other equipment purchases. However, real estate purchases seem less certain.

- State and Local Tax (SALT) deduction

Entrepreneurs living in high-tax states have felt the pain of the $10,000 cap the TCJA put on deducting state and local taxes. Intense pressure from lawmakers in certain states with high-income residents will likely lead to an increase in this deduction. Without action by Congress, the cap will expire at the end of 2025. However, given concerns over the budget deficit, it’s more likely that we will see lawmakers opt to increase the cap.

- Fewer, if any, green energy incentives

In recent years, entrepreneurs and investors have made good use of several tax incentives that promote investments in electric vehicles, solar power systems, wind farms and other renewable energy and environmental efforts. The Inflation Reduction Act of 2022, in particular, included significant tax credits for the cost of renewable energy systems.

President-elect Trump advocated for a more oil and natural gas-centric energy policy on the campaign trail, calling President Biden’s energy policy a “new green scam.” So, if the current incentives are part of your tax strategy, it is wise to connect with your tax advisor to discuss alternatives.

That said, it’s also possible that those incentives will remain while others for fossil fuel-related energy projects will return. The president-elect has expressed support for U.S. energy independence, and he named North Dakota Gov. Doug Burgum — who supports both oil and renewable production — his choice to lead a new National Energy Council.

How to prepare

Here is the good news. While most entrepreneurs have little influence over how these policies will shake out following the inauguration, the fundamentals of creating a good tax strategy will not change.

Remember: Your tax is based on your unique set of facts. To change your tax, you just need to change your facts.

How do you do this? The tax law is a series of incentives designed to influence how people earn and invest their money. The key is to pay attention to how the tax law changes and shift your strategy accordingly. Stay informed and work with an advisor who will partner with you on a long-term approach to minimize taxes while maximizing your wealth.

Read the full article here