Chris Hughes’s Market Crafters: The 100‑Year Struggle to Shape the American Economy, published just a few weeks ago in the Spring of 2025, is a masterful, humanizing journey through a century of U.S. economic history. Hughes—economist, former English major, Harvard roommate of Mark Zuckerberg turned multimillionaire after selling his Facebook stock, and public intellectual—brings a storyteller’s instinct to a traditionally arid subject. He can make Fed policy gripping. His background makes him uniquely compelling: he understands both language and markets, and he writes with clarity but does not condescend to the reader.

He shatters the myth that free markets alone produced American prosperity. Instead, he chronicles a persistent, bipartisan tradition of “market crafting”: the deliberate use of government authority to shape markets—investing, regulating, and stabilizing—for public benefit. This narrative covers episodes ranging from Jesse H. Jones’s Reconstruction Finance Corporation in the 1930s to modern semiconductor policy under Trump and Biden.

Hughes’s first book, Fair Shot: Rethinking Inequality and How We Earn, landed in February 2018. He began convinced that unconditional cash was the silver bullet for inequality. Over the course of his research, however, he shifted his position, recognizing the indispensability of public infrastructure—roads, schools, regulatory systems—that cash alone doesn’t supply. It was an evolution worth noting, and in Market Crafters, that same curiosity drives a deeper exploration of institutional design.

In 2019, Hughes authored a landmark essay in The New York Times calling for Facebook’s breakup, the company he worked hard to build. That early and incisive stance on monopoly power foreshadows the themes that animate Market Crafters. Here, Hughes investigates the people and lawmakers – including it seems, Trump and Biden, who worry monopolies thrive when markets go uncrafted and how careful tariff, tax breaks, and direct investment can restore competition and innovation.

What Market Crafters Covers

The heart of the book is its cast of characters—detail-rich portraits of decision-makers whose lives shaped policy. These include Jesse H. Jones, William McChesney Martin, Arthur Burns, Nancy Teeters, Paul Volcker, Alan Greenspan, Lina Khan, Jake Sullivan, Brian Deese, Felicia Wong, and many others. Hughes’s approach isn’t ideological: he grants respect to pragmatic leaders—Republican and Democrat—who leveraged the tools of statecraft to stabilize and invigorate the economy.

What is market craft? Chris Hughes writes “it’s the intentional use of state power to shape markets towards the political goal of stability. In the depression “the alternative – – cascading bankruptcies in the banking, agricultural railroad sectors was out of the question.”

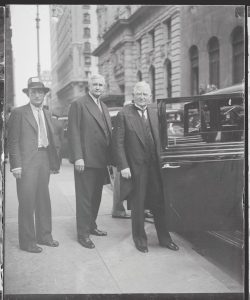

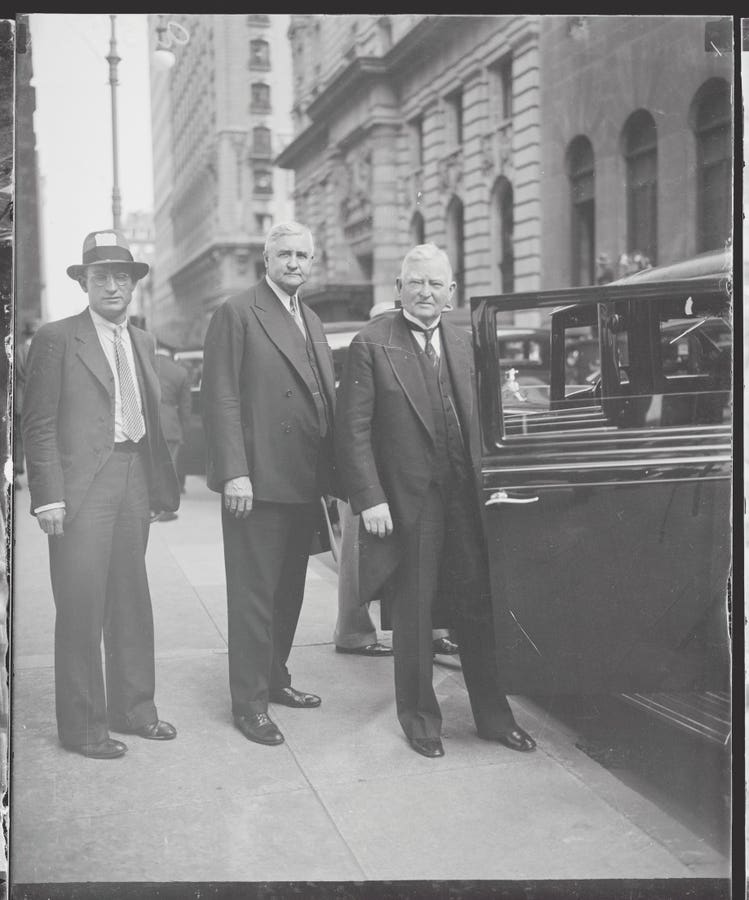

Possibly the most satisfying lesson in marketcrafting comes early with Jesse H. Jones, who served as head of the RFC from 1932 until 1939. The RFC was not just a wartime lender—it was essentially a federal investment bank, channeling billions into faltering banks, railroads, and farms. Between 1932 and 1935, Jones authorized the distribution of about $74 billion in today’s dollars. His vision of combining government money with private capital to prevent cascading bankruptcies defines “market crafting”: the calculated, visionary use of public power to engineer stability.

Central Banking as “Market Craft”

Hughes devotes a section to the Federal Reserve’s transformation. William McChesney Martin—Fed Chair from 1951 to 1970—famously insisted that the Fed’s job was “to take away the punch bowl just as the party’s getting started.” And Hughes quotes him saying something like ‘Markets are nursed along as children are nursed along,’ explaining that policymakers guide markets because unregulated forces would otherwise leave economies vulnerable.

Hughes also recalls Martin’s innovation known as “Operation Twist” in the 1960s, whereby the Fed sold short-term Treasuries to buy long-term bonds—an early instance of yielding to market needs without monetary expansion.

Nancy Teeters, appointed in 1978 as the first woman to serve on the Federal Reserve Board of Governors, is remembered not as a Chair but as a pathbreaker who often dissented during times of macroeconomic turbulence. Her role illustrates how even non‑chair governors can steer policy by holding the institution accountable for balance, not adherence to any dogma.

Skipping ahead to the 2008 Hughes recounts the turbulent 2008 financial crisis. Bear Stearns was rescued on March 16, 2008, by JPMorgan Chase with a $30 billion-backed Fed loan—a classic move in the tradition of market crafting. By contrast, Lehman Brothers was left to fail when it filed for bankruptcy on September 15, 2008, triggering global financial panic. The about-face in policy reflects a tension between the ideological belief that NOT creating moral hazard was the most important policy goal. Hughes suggests the imperative of preventing systemic collapse was not in focus because the Treasury Secretary, Hank Paulson’s, belief in the market’s ability to discipline itself and snap back. Paulson insisted in public statements that he wasn’t going to tolerate bailouts. Just a few weeks later the officials learned a different lesson and bailed out AIG.

Trump, Biden, Industrial Policy and Market Crafting

The final chapters examine how both President Trump and President Biden departed from neoliberal economic policies to embrace market crafting to boost investment in key industries. Trump’s Operation Warp Speed is framed not only as a public-health success but also as a market-crafting intervention: the federal government intervened directly in private pharmaceutical markets to ensure vaccine development and distribution.

Biden led bold market crafting and perhaps his boldness came from years of experience as Vice President and Senator. He knew government could shape markets. And he knew it was in the American tradition. He wanted to help the middle class and create jobs. During the campaign he said to potential donors,‘ My Lord, look at what is possible, looking at the institutional changes we can make, without us becoming a ‘socialist country’ or any of that malarkey.”

Biden signed the CHIPS and Science Act on August 9, 2022, authorizing approximately $52.7 billion in direct semiconductor investments and research support, as part of a broader $280 billion science and technology initiative.

What surprised many is how bipartisan the push became, with Republicans such as Senators Marco Rubio, Josh Hawley, and Todd Young. Hughes discusses their rethinking and departure from free market ideology on the same page as he describes Democrat Senator Elizabeth Warren’s support for market crafting.

Through these actions, Hughes suggests industrial policy is no longer a partisan liability but a pragmatic necessity. Both presidents, despite different rhetoric, drew from the same script: government can steer market outcomes for national stability and innovation.

Market Crafting Needs A Federal Investment Bank

Hughes argues for a modern federal investment bank. It’s hardly un-American—after all, the RFC came first. By tracing a narrative arc back to Jesse H. Jones and the Reconstruction Finance Corporation, Hughes suggests that a federal investment bank is not a radical departure, but a deeply American institution.

The bank would have to be well – designed so it was evergreen, it could function across swings in administrations, resist capture, and catalyze public‑interest investment. He writes, “With smart design, a national investment bank could harness markets for social and political goals while building durable institutional expertise that outlasts any single administration.

”Market Crafters is not a partisan tract but an exploration of economic policymaking in action. It is, above all, a tribute to institutions that adapt and the people who create and recreate them — RFCs, central banks, federal agencies. Readers get a renewed appreciation for American policymakers who navigated crises and steered the economy by not by retreating to free-market dogma – most of the time — but crafting and shaping markets.

Chris Hughes surprisingly readable economic history foregrounds the personalities behind policy while making a robust case for public policymaking as an art of market design. He makes the same argument in a recent New York Times article describing President Trump’s conflict with Fed Chief Jerome Powell.

Hughes book shows how, when governments act deliberately and skillfully, they can steady economies, spur innovation, and avert disaster. For anyone grappling with questions about tariffs, pandemic-era bailouts, industrial strategy, or Fed policy, Market Crafters provides both context and an invitation—to consider that markets are not self-executing, but human-crafted.

Read the full article here