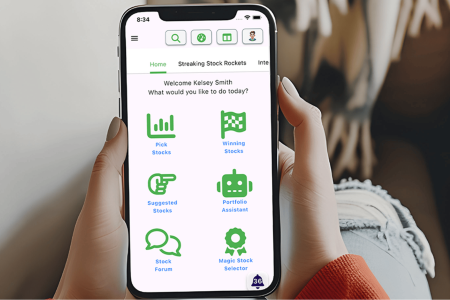

Generac generators sit stacked in a warehouse. The company is working through an inventory glut.

Tim Boyle/Bloomberg

Sometimes growth stocks fall on hard times, leaving investors to ponder whether the good times will ever return. In the case of

Generac Holdings,

it’s a good time to buy a growth stock at a value price.

Generac (ticker: GNRC) had been a consistent growth story, compounding earnings and revenue for most of its history on the market—even through the Covid-19 pandemic. Not so this year. The maker of power-generation equipment is forecast to show a 37% drop in net income on a 11% decline in revenue in 2023. Ouch.

Its stock has suffered accordingly. Shares are down 56% over the past year, and 35% since Barron’s recommended buying them on Sept. 22.

Back then, we cited the growing demand for backup power generators from homeowners and businesses. Generac, which has a market value of $6.8 billion, controls some three-quarters of the U.S. market for standby generators that can power a house through blackouts or other disruptions to the electricity supply.

More frequent and destructive natural disasters, paired with growing demand from electric vehicles and other uses, add stress to grids. The average American electricity customer lost power for more than seven hours in 2021, according to the latest government data available. That’s up from four hours on average five years earlier. Generac’s products help keep the lights on.

Many of the biggest potential markets for Generac’s generators have very low rates of installed generators. Take California, where fewer than 2.5% of homes have standby power, versus many Northeastern states with penetration rates between 10% and 20%.

With that kind of potential growth ahead, Generac regularly traded at a forward price/earnings multiple in the mid-20s, a premium to other mid-cap industrial stocks. Generac, though, now trades at just 16 times, as the company works through an inventory glut—an error of management’s own making that was supposed to be resolved by now, but instead continues to weigh on sales and earnings.

At the end of the second quarter, Generac’s inventory levels were still around 20% to 30% higher than normal—a 20-percentage-point improvement from the previous quarter, but short of management’s own expectations—and the company now expects it will take until the end of 2023 to get inventory balances back to normal. That prompted a cut to Generac’s full-year revenue and earnings guidance, sending shares tumbling 24% in a day on Aug. 2.

The dip in the stock more than compensates for the delay in inventory normalization, which doesn’t impact the long-term story. Truist Securities analyst Jordan Levy upgraded Generac stock to Buy after the drop, with an unchanged price target of $160—up 45% from a recent $110.

“[We see an] attractive entry point for investors to gain exposure to a well-established name in home/commercial backup power with upside potential from a recovering Clean Energy segment,” Levy wrote.

Generac management will host an investor day in late September that could be a positive catalyst for the shares—the event might focus on the company’s promising clean-energy segment—but that’s not the only reason to like the shares. Headlines about heat waves and natural disasters can prompt sharp short-term moves in the stock.

In fact, October, the peak month of the Atlantic hurricane season, has been particularly good for Generac, with the stock rising in 10 of 13 times that month since going public in 2010, with a median gain of 12%. Shares also tend to jump 10% the morning after a major storm makes landfall in Florida or Texas.

It is stormy times for the quintessential “storm stock,” but Generac’s growth story is far from over.

Write to Nicholas Jasinski at [email protected]

Read the full article here