You’ve heard it before: “Buy low, sell high”. In an ideal world, that advice is a no-brainer. You want me to purchase something when it is at its lowest price and then sell it when you know you can get the most money for it possible? If we all had a crystal ball, then this would work perfectly.

However, assuming you can’t predict the future, buying low and selling high can be a bit more complicated. Trying to time the market is near impossible, which is why it is so important that when you are investing your money, you are investing in a way that aligns with your personal goals.

Of course, when you see the negative figures scrolling across the TV screen on CNBC or read the alarmist headlines in the Wall Street Journal, it can be hard to resist the urge to move your money out of the stock market. Studies have shown that we feel the pain of loss twice as severely than we feel the joy of gains. However, in most cases, selling your holdings for cash (or other cash equivalent funds) is not a good idea.

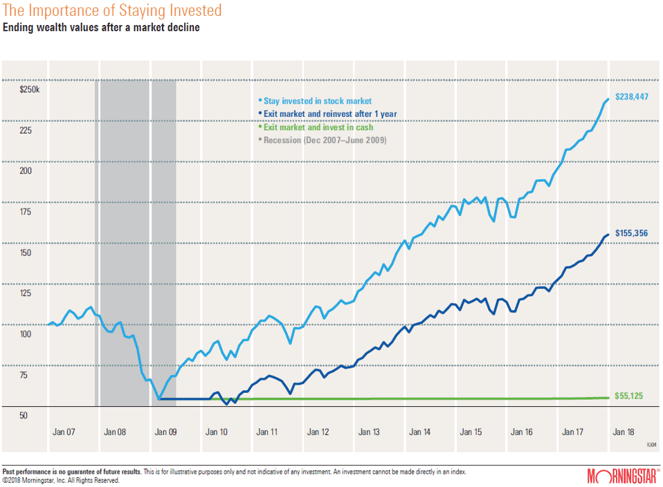

Let’s look at two hypothetical examples from the 2008/2009 Recession. Let’s say two people, Billie and Taylor, each had $100,000 invested in the S&P 500 at the time of the market’s low on March 9, 2009. Billie panicked and strayed from their initial plan, deciding to get out of the S&P 500 and move their account to cash. From the time they moved their money in 2009 through December 31, 2019, the $100,000 Billie moved to cash is still worth $100,000.

However, let’s compare that to Taylor, who decided to take no action and keep their money invested in the stock market. Between the low in March 2009 through December 2019, Taylor saw their funds grow by roughly 305%. That means their $100,000 of S&P 500 stock grew!

Even if we look at their returns through March 31, 2020 to take into account our recent market volatility, Taylor would still have seen their account grow 224%.

Maintaining faith that the market will recover and staying the course rewarded Taylor in the long-run.

So, what can you do when the market starts going on a roller coaster ride and you’re feeling uneasy?

1. Review your account’s purpose and how long you have until you will use this money.

Why are you investing your savings? Is it to buy a house in the near future? Are you hoping to fund your kid’s college expenses? Are you saving long-term for your retirement? Knowing how long you have to let the markets recover before you need to use your funds should help drive your investment strategy. Keep in mind that historically, it has taken an average of two years for the stock market to recover from a bear market. A good rule of thumb – If you don’t need to use your funds within the next two years, then waiting it out and giving the market time to recover usually makes the most sense. Additionally, if you intend to use this money within the next 5- to 7-years, you will have less time to allow the stock market to recover and should think about moving your account into an investment that is more stable, such as a money market fund.

2. Don’t over-check your account

If you are sitting in front of CNBC watching the green and red tickers scroll along the screen and refreshing your investment account login every five minutes, I’m going to ask you to put the mouse down, turn off the TV and step away. Yes, it is good to review your account. But checking it too much can cause anxiety that leads to making emotional decisions. If you have completed step 1, and know you don’t anticipate needing the money in your account for the foreseeable future, then let your investments do their thing. That said, still review your investment strategy once or twice a year to ensure you’re still saving in the best way to meet your goals.

3. Consider taking advantage of the market decline and invest more at a lower price.

It may seem counter intuitive, but if you have extra cash on hand, now might be a great time to invest more of your money. If you saw a pair of shoes that you knew were worth $100 on sale for $75, you’d think that was a great deal. The same holds true for the stock market. View these dips as buying opportunities and take advantage of the lower prices.

*These examples are not indicative of any future performance, your experience may vary. All indices are unmanaged and investors cannot actually invest directly into an index. Unlike investments, indices do not incur management fees, charges, or expenses. Past performance does not guarantee future results.

Read the full article here