Key takeaways

- The stock markets have lost sizeable gains in August

- Inflation, the bonds market and China’s economic recovery are all factors in the global declines

- It’s too early to tell if this is a temporary blip or the beginning of a bear market

What’s happening with the stock market? After seven months of steady inclines, the S&P 500 has seen a quarter of those gains lost in just three weeks. It’s a turbulent time for what’s usually a quiet month, but a few factors are dragging down stocks.

The question investors have is whether the drop is temporary or if we’re heading towards a more significant decline. With domestic and international factors at play, it’s difficult to say what could happen next. Get ready for a breakdown of why the stock market has underperformed in August.

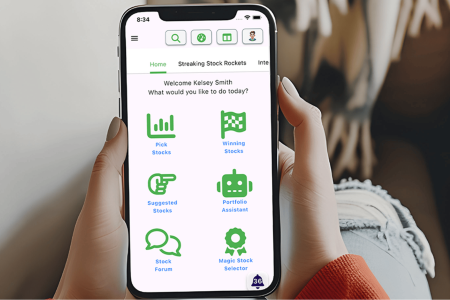

Global events can weigh on the U.S. markets, which is a reminder that diversifying into international assets can boost your investing strategy. Q.ai’s Global Trends Kit is here to help. This curated collection is managed by an AI algorithm that vigilantly tracks economic and market trends across different continents.

The AI helper adjusts your asset mix to ensure you’re capturing the most promising international growth opportunities, all while helping to mitigate risks inherent to global investing by analyzing data to keep you ahead of the global curve.

Download Q.ai today for access to AI-powered investment strategies.

What’s weighing on the stock market?

So far in August, the S&P 500 has lost 4.5%, the Nasdaq has declined 6.5%, and the Dow Jones Industrial Average has fallen 3.1%. As a result, all mega-cap stocks have also lost collective billions in value: Tesla has shed over 17%, Meta has lost over 12%, and Apple has fallen 10%, to name a few.

So, what’s driving the losses after such a good seven months? As always, there isn’t one solid factor underpinning everything but a maelstrom of different situations coming together to drag down the markets.

Bond yields

Bonds are considered to be steadier income than stocks, which can fluctuate, so stocks tend to fall when bond yields are high. That’s what we’re seeing happen now: the ten-year Treasury bond is currently yielding 4.31%, the highest level since October 2022. If it surpasses 4.34%, the bond will have the highest yield since 2007.

The two-year Treasury yield, which is sensitive to Fed policy plans, is currently 4.975%, while the 30-year Treasury bond is presently offering a 4.446% yield. As for short-term Treasury bills, three and six-month T-bills are boasting yields of over 5.4%.

It’s a reflection that the economy is doing well, but it’s the Treasury market slipping into negative yearly returns last week that sparked a sell-off in long-term bonds, pushing the prices up. Yields are also still in an inverted curve, which is usually a prediction of an impending recession.

Higher bond yields have the potential to weigh on inflation by making borrowing more expensive for businesses and consumers. If companies pass on the cost of goods and services, inflation could persist longer than previously thought. Higher bond yields make spending more expensive for the government, which already has a debt of $1.6 trillion. In short, bonds are good for savers but bad for stocks and borrowers.

Inflation pressures

We all know the inflation war has been waged for 18 months now, but Wall Street was expecting the battle to be further along at this stage. Stocks fell further after the Fed’s July meeting notes were released, confirming that at least two committee members felt raising rates could be premature.

At the July press conference, Fed chair Jerome Powell said, “We intend, again, to keep policy restrictive until we’re confident that inflation is coming down sustainably toward our 2% target”. That’s left investors concerned interest rate cuts might not happen early next year, as they’d predicted, with more hikes to come.

Inflation may be tricky to bring down to 2% now the worst of it is over. The Atlanta Fed GDPNow tracker now estimates that U.S. growth for the third quarter will be 5.8%, citing positive housing and production reports. In any circumstance is a brilliant outcome, but it’s particularly extraordinary given interest rates are at their highest levels in 22 years.

Powell is set to speak at the Jackson Hole meeting this week, which investors will be watching closely for any hints about the short-term economic policy. With anticipated skyrocketing GDP growth and high bond yields, focusing on the positives is a no-brainer, which could trigger another short-term stocks decline.

China’s faltering economy

After the Chinese government lifted the punitive Covid lockdown restrictions in the country, everyone assumed the economy would come roaring back. Instead, the opposite has happened, and the world’s second-largest economy faltering has global implications.

The Chinese property market has been a simmering issue for years, and we may be about to see it reach boiling point. Years of aggressive expansion into infrastructure and housing left developers in heavy debt as housing prices soared.

Now, the house of cards is falling. Chinese property developer Evergrande Group is asking a U.S. court to approve its restructuring plan to avoid bankruptcy and defaulting on its $340 billion debt load, with others having failed since China tightened corporate regulation in 2020. For July, China’s National Bureau of Statistics said new home prices across 70 cities fell 0.23%, following a 0.06% dip in June. Roughly 70% of Chinese households’ wealth stems from property, slowing the market as the uncertainty continues.

On top of that, China’s economy has fallen into deflation, when inflation goes negative. Youth unemployment is over 21%, and the yuan’s value has plummeted. It’s weighed heavily on the markets – the Hang Seng index in Hong Kong has fallen 10.6% in August, while the mainland CSI 300 Index has declined 6.7%.

The bottom line

It’s not been a fun time for the stock market in August, which usually sees a small dip due to summer breaks – but this is something else entirely. The bonds market is going sharply upwards, the Fed has indicated there’s more to be done with interest rates in taming inflation, and the Chinese economy is drastically underperforming without a clear path ahead.

These affect the economy’s short- and medium-term health, as mortgages and loans become more expensive and weigh on consumer spending. Given the U.S.’s hard work in bringing down inflation, perhaps some of that luck is about to run out.

Imagine having a portfolio that’s as well-traveled as you aspire to be. With Q.ai’s Global Trends Kit, you can achieve just that. This Kit offers a diversified set of international assets to expose your portfolio to the world’s most dynamic markets.

But you won’t be going it alone; an advanced AI algorithm will manage your holdings, making real-time adjustments based on complex data analytics to help ensure your portfolio stays aligned with opportunities in the global landscape.

Download Q.ai today for access to AI-powered investment strategies.

Read the full article here