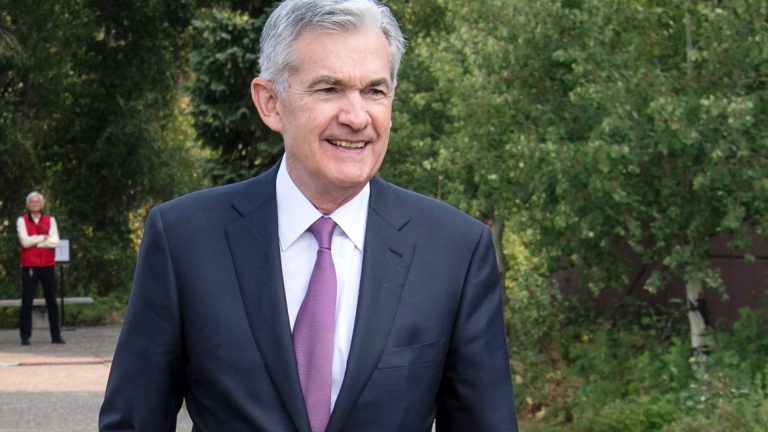

It sure didn’t take long to forget the halcyon days of early summer, did it? We came into August with a full head of steam – and then we found ourselves derailed by Apple ‘s (AAPL) quarter and ever since then nothing’s worked right. The bulls have simply been unable to put any points on the board. Worse, we find ourselves with the one-two punch of Club name Nvidia (NVDA) reporting quarterly results this Wednesday and central bankers convening in Jackson Hole, where Federal Reserve Chair Jerome Powell will provide an economic outlook on Friday. Those events could knock out the bulls for the quarter, and we’re still in August. Looking back, it all went sour with Club holding Apple, not the recent macroeconomic data. It’s amusing to see Apple play such a pernicious role in this seemingly perilous moment. The headlines maintained a narrative of ‘Apple sees third straight quarter of falling sales’ – as if, somehow, that was a surprise. It wasn’t to anyone I know. In fact, the surprises were better-than-expected iPhone 14 sales for this point in a phone cycle, strong Chinese sales and robust services sales. Somehow it didn’t matter. Now there’s a shroud that threatens to put a damper on Nvidia, which may not deliver the numbers because it’s sold out and can’t do better than sold out. (Those who are taking that as a sell call, stop reading right now: I don’t want you to be able to take advantage of my staying inside and doing work on this beautiful Sunday). I think all of this is preposterous. I think the primacy of tech is ridiculous at this point. But we have a buyers’ strike on so many different sectors, we can’t be sure what to make of tech, or anything else for that matter. Some way-too-late government rules for banks don’t help. Nor do the sell-offs on what really were better than expected earnings from Home Depot (HD) and Walmart (WMT). And we are losing leadership like mad. The housing stocks have been annihilated because of higher interest rates. The affordability index is flashing red, but we have to come to grips with the notion of a lack of homes being built. We need 2 million homes to break the price of housing from the supply side. Or we need a buyers’ strike in homes, too. More broadly, we have parallel tracks of weakness: bonds that are cratering and stocks that are doing the same. But I don’t think they are as related as most would have you believe. Bonds are cratering and yields moving higher because of a huge amount of supply and a continual recognition by the bond bulls that they just got it all wrong. The gigantic hedge funds seem to have gotten this yield curve business so stupendously incorrect that the unwind is like a snapped power line swinging in the breeze burning the heck out of anyone who comes near it. Even if the Fed raises interest rates two more times and Powell issues a hawkish statement from Jackson Hole, I believe that long rates will meet short rates and the inversion will be over. The irony is not lost on me that we might actually have a real slowdown if that finally happens. But I don’t believe it will play out like that. I think that the economy will just keep slowing, but we won’t land. Believe me I would not be that sanguine if it weren’t for all of the federal monies coming our way. The stock market, meanwhile, is continuing to go down for a number of reasons. The first is the indictment of former President Donald Trump in Georgia. Until that indictment, everything seemed either procedural or small potatoes. This one isn’t. A hub-and-spoke-conspiracy case causes people to turn on each other. It’s a prisoner’s dilemma writ large and it is very hard to dodge. Until this I thought that the cases actually cut in favor of Trump and rallied his base. This one just seems like common crime and that’s hard to beat. I am cognizant that, hate him or like him, Trump is considered to be far more positive for business than President Joe Biden. Suffice it to say that, if the Georgia case were to knock out Trump, there is no viable pro-markets candidate around. We don’t know what these other folks stand for except then it comes to moral rights. Those who were hoping for a Republican in the White House truly met their match with this Georgia indictment. Then there’s the unions. And after decades they sure did come back with a vengeance. The situation with the United Automobile Workers (UAW) is right out of the Walter Reuther playbook. Maybe even more anti-capitalist, judging by the rhetoric. I think these unions are out to re-create the American middle class after a prolonged period in which CEOs have made far more money than workers. The difference between now and, say, when Ronald Reagan was president, is nightmarish. Big CEOs pay themselves enough that if they just took half and gave the rest to the workers in a one-time distribution, these labor disagreements wouldn’t be happening. But the unions threaten shareholders in a legitimate way, and we just aren’t used to it. Going forward, it will be a black mark on a company to be unionized. Lastly, there is China’s faltering economic recovery. The policy errors are pretty unimaginable. Chinese President Xi Jinping is nothing short of a communist Herbert Hoover. He doesn’t seem to realize that it’s time to shutter the loser institutions, get their assets into the equivalent of a Resolution Trust Corporation, and start printing money. Now, I am not banking on the Chinese staging a huge comeback. But my point is that they don’t have to. A slow China could have been devastating pre-Trump. But – once again, hate him or like him – Trump made you a pariah if you depended on China for growth. That means our companies are a lot better off than most. But the bears on China are desperate to extrapolate to markets. When you put it together, it’s tough to create a positive scenario right now. Rallies seem to be based on short covering. Anything less than a Nvidia blowout will be cause to re-examine the greatest story of the era: artificial intelligence. A Powell speech filled with rates needing rise to 6% if unemployment doesn’t go to 4% won’t help. The best the bulls can play for is a tie — either a Nvidia beat or more dovish rhetoric from the Fed, but not both. And then maybe some relief until the next China debacle. I remain steadfast that patience is called for. I am not going to tell you to buy stocks like mad, especially as the market is not outrageously oversold. And I am not going to tell you to sell everything with the possibility of a strong fall because things really aren’t that bad. Pre-Apple we were having a grand-old second-quarter earnings season. So, let’s be patient. Let’s pick when its down big. Let’s not sell when it rallies. And let’s see if patience doesn’t reward us! (See here for a full list of the stocks in Jim Cramer’s Charitable Trust.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

It sure didn’t take long to forget the halcyon days of early summer, did it? We came into August with a full head of steam – and then we found ourselves derailed by Apple‘s (AAPL) quarter and ever since then nothing’s worked right.

Read the full article here