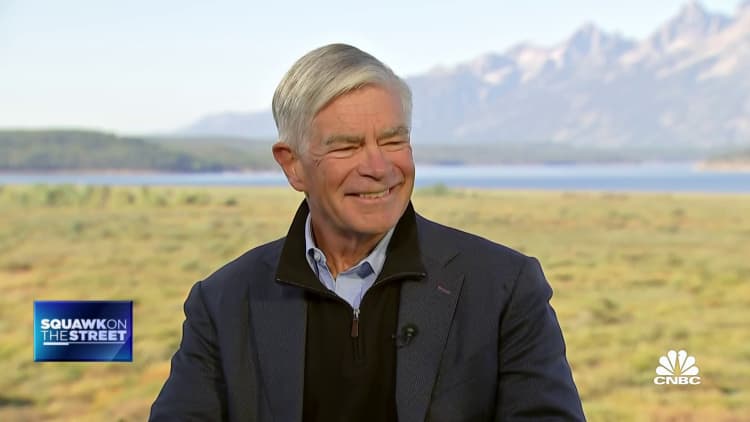

Since he took over the chair’s position at the Federal Reserve in 2018, Jerome Powell has used his annual addresses at the Jackson Hole retreat to push policy agendas that have run from one end of the policy playing field to the other.

In this year’s iteration, many expect the central bank leader to change his stance so that he hits the ball pretty much down the middle.

With inflation decelerating and the economy still on solid ground, Powell may feel less of a need to guide the public and financial markets and instead go for more of a call-’em-as-we-see-’em posture toward monetary policy.

“I just think he’s going to play it about as down the middle as possible,” said Joseph LaVorgna, chief economist at SMBC Nikko Securities America. “That just gives him more optionality. He doesn’t want to get himself boxed into a corner one way or another.”

If Powell does take a noncommittal strategy, that will put the speech in the middle of, for instance, 2022’s surprisingly aggressive — and terse — remarks warning of higher rates and economic “pain” ahead, and 2020’s announcing of a new framework in which the Fed would hold off on rate hikes until it had achieved “full and inclusive” employment.

The speech will start Friday about 10:05 a.m. ET.

Nervous markets

Despite the anticipation for a circumspect Powell, markets Thursday braced for an unpleasant surprise, with stocks selling off and Treasury yields climbing. Last year’s speech also featured downbeat anticipation and a sour reception, with the S&P 500 off 2% in the five trading days before the speech and down 5.5% in the five after, according to DataTrek Research.

A day’s wavering on Wall Street, though, is unlikely to sway Powell from delivering his intended message.

“I don’t know how hawkish he needs to be given the fact that the funds rate is clearly in restrictive territory by their definition, and the fact the market has finally bought into the Fed’s own forecast of rate cuts not happening until around the middle or second half of next year,” said LaVorgna, who was chief economist for the National Economic Council under former President Donald Trump.

“So it’s not as if the Fed has to push back against a market narrative that’s looking for imminent easing, which had been the case from essentially most of the past 12 months,” he added.

Indeed, the markets seem finally to have accepted the idea that the Fed has dug in its heels against inflation and won’t start backing off until it sees more convincing evidence that the recent spate of positive news on prices has legs.

Yet Powell will have a needle to thread — assuring the market that the Fed won’t repeat its past mistakes on inflation while not pressing the case too hard and tipping the economy into what looks now like an avoidable recession.

“He’s got to strike that chord that the Fed is going to finish the job. The fact is, it’s about their credibility. It’s about his legacy,” said Quincy Krosby, chief global strategist at LPL Financial. “He’s going to want to be a little more hawkish than neutral. But he’s not going to deliver what he delivered last year. The market has gotten the memo.”

Inflation’s not dead yet

That could be easier said than done. Inflation has drifted down into the 3%-4% range, but there are some signs that slowdown could be reversed.

Energy prices have risen through the summer, and some factors that helped bring down inflation figures, such as a statistical adjustment for health-care insurance costs, are fading. A Cleveland Fed inflation tracker anticipates August’s figures will show a noticeable jump. Bond yields have been surging lately, a response that at least partly could indicate an anticipated jump in inflation.

At the same time, consumers increasingly are feeling pain. Total credit card debt has surpassed $1 trillion for the first time, and the San Francisco Fed recently asserted that the excess savings consumers accumulated from government transfer payments will run out in a few months.

Even with worker wages rising in real terms, inflation is still a burden.

“When all is said and done, if we don’t quell inflation, how far are those wages going to go? With their credit cards, with food, with energy,” Krosby said. “That’s the dilemma for him. He has been put into a political trap.”

Powell presides over a Fed that is mostly leaning toward keeping rates elevated, though with cuts possible next year.

Still no ‘mission accomplished’

Philadelphia Fed President Patrick Harker is among those who think the Fed has done enough for now.

“What I heard loud and clear through my summer travels is, ‘Please, you’ve gone up very rapidly. We need to absorb that. We need to take some time to figure things out,'” Harker told CNBC’s Steve Liesman during an interview Thursday from Jackson Hole. “And you hear this from community banks loud and clear. But then we’re hearing it even from business leaders. Just let us absorb what you’ve already done before you do more.”

While the temptation for the Fed now might be to signal it has largely won the inflation war, many market participants think that would be unwise.

“You’d be nuts to you know, to put out the mission accomplished banner at this point, and he won’t, but I don’t see any need for him to surprise hawkish either,” said Krishna Guha, head of global policy and central bank strategy for Evercore ISI.

Some on Wall Street think Powell could address where he sees rates headed not over the next several months but in the longer run. Specifically, they are looking for guidance on the natural level of rates that are neither restrictive nor stimulative, the “r-star (r*)” value of which he spoke during his first Jackson Hole presentation in 2018.

However, the chances that Powell addresses r-star don’t seem strong.

“There was a sort of general concern that Powell might surprise hawkish. The anxiety was much more about what he might say around r-star and embracing, high new normal rates than it was about how he would characterize the near-term playbook,” Guha said. “There’s just no obvious upside for him in embracing the idea of a higher r-star at this point. I think he wants to avoid making a strong call on that.”

In fact, Powell is mostly expected to avoid making any major calls on anything.

At a time when the chair should “take a victory lap” at Jackson Hole, he instead is likely to be more somber in his assessment, said Michael Arone, chief investment strategist at State Street’s US SPDR Business.

“The Fed likely isn’t convinced inflation has been beaten,” Arone said in a note. “As a result, there won’t be any curtain calls at Jackson Hole. Instead, investors should expect more tough talk from Chairman Powell that the Fed is more committed than ever to defeating inflation.”

Read the full article here