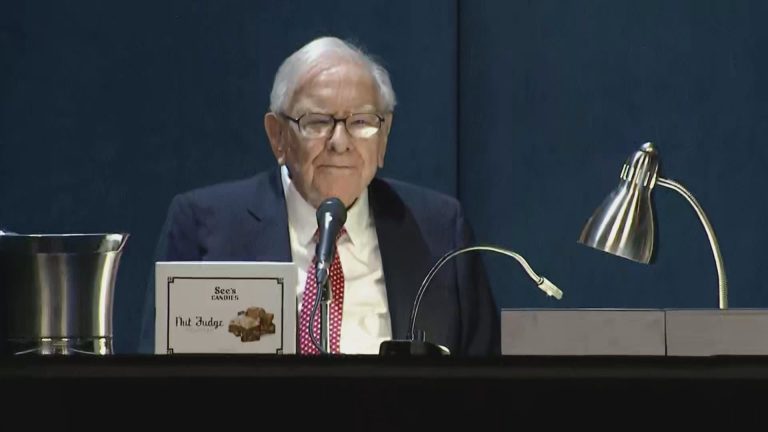

Warren Buffett finally revealed his secret stock pick in a new regulatory filing, and it’s insurer Chubb.

His conglomerate Berkshire Hathaway has acquired nearly 26 million shares of Chubb for a stake worth $6.7 billion. The property and casualty insurer became Berkshire’s ninth biggest holding at the end of March.

Berkshire has been buying a mystery stock for three quarters straight. Berkshire was granted confidential treatment to keep the details of one or more of its stock holdings confidential.

Many had speculated that the secret purchase could be a bank stock as the conglomerate’s cost basis for “banks, insurance, and finance” equity holdings jumped by $1.4 billion in the first quarter after an increased of $3.59 billion in the second half of last year, according to separate Berkshire filings.

It’s relatively rare for Berkshire to request such a treatment. The last time it kept a purchase confidential was when it bought Chevron and Verizon in 2020.

This is breaking news. Please check back for updates.

Read the full article here