Our goal here at Credible Operations, Inc., NMLS Number 1681276, referred to as “Credible” below, is to give you the tools and confidence you need to improve your finances. Although we do promote products from our partner lenders who compensate us for our services, all opinions are our own.

Based on data compiled by Credible, mortgage rates for home purchases have risen for one key term, fallen for another, and remained unchanged for two more since yesterday.

Rates last updated on August 31, 2023. These rates are based on the assumptions shown here. Actual rates may vary. Credible, a personal finance marketplace, has 5,000 Trustpilot reviews with an average star rating of 4.7 (out of a possible 5.0).

What this means: Mortgage purchase rates for 20- and 30-year terms have remained at 8.125% for nearly three weeks. Additionally, rates for 10- and 15-year terms have stayed in the 6% range since the middle of August. Today, rates for 15-year terms have edged down to 6.125%. Meanwhile, rates for 10-year terms have edged up to 6.375%. Borrowers looking to maximize their interest savings should consider 15-year terms, as 6.125% is today’s lowest purchase rate. Homebuyers who would rather have a smaller monthly payment should instead consider either of today’s longer terms.

To find great mortgage rates, start by using Credible’s secured website, which can show you current mortgage rates from multiple lenders without affecting your credit score. You can also use Credible’s mortgage calculator to estimate your monthly mortgage payments.

Based on data compiled by Credible, mortgage refinance rates have remained unchanged for two key terms, while two others have fallen since yesterday.

Rates last updated on August 31, 2023. These rates are based on the assumptions shown here. Actual rates may vary. With 5,000 reviews, Credible maintains an “excellent” Trustpilot score.

What this means: Mortgage refinance rates have continued to remain in the 6% range, with longer terms maintaining this pattern for the past three days, and shorter terms since the beginning of this month. Today, rates for 10- and 20-year terms have remained unchanged, staying at 6.25% and 6.75%, respectively. Meanwhile, rates for 15- and 30-year terms have both edged down, hitting 6% and 6.875%, respectively. Homeowners looking to refinance into a lower monthly payment should consider 20-year terms, as their rates are lower than those of 30-year terms. Borrowers who would rather save the most on interest should instead consider 15-year terms, as 6% is today’s lowest refinance rate.

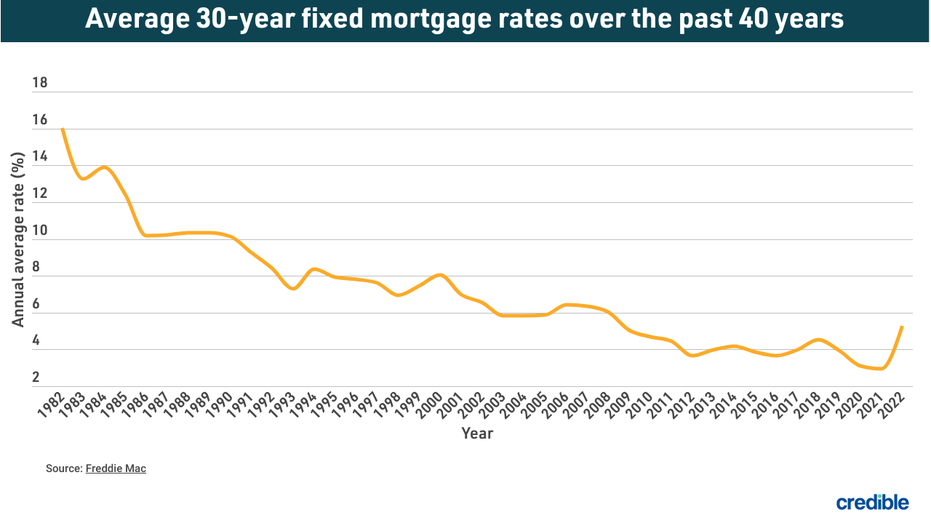

How mortgage rates have changed over time

Today’s mortgage interest rates are well below the highest annual average rate recorded by Freddie Mac — 16.63% in 1981. A year before the COVID-19 pandemic upended economies across the world, the average interest rate for a 30-year fixed-rate mortgage for 2019 was 3.94%. The average rate for 2021 was 2.96%, the lowest annual average in 30 years.

The historic drop in interest rates means homeowners who have mortgages from 2019 and older could potentially realize significant interest savings by refinancing with one of today’s lower interest rates. When considering a mortgage or refinance, it’s important to take into account closing costs such as appraisal, application, origination and attorney’s fees. These factors, in addition to the interest rate and loan amount, all contribute to the cost of a mortgage.

How Credible mortgage rates are calculated

Changing economic conditions, central bank policy decisions, investor sentiment and other factors influence the movement of mortgage rates. Credible average mortgage rates and mortgage refinance rates reported in this article are calculated based on information provided by partner lenders who pay compensation to Credible.

The rates assume a borrower has a 700 credit score and is borrowing a conventional loan for a single-family home that will be their primary residence. The rates also assume no (or very low) discount points and a down payment of 20%.

Credible mortgage rates reported here will only give you an idea of current average rates. The rate you actually receive can vary based on a number of factors.

How do I get a mortgage?

When you’re ready to buy a home, you should lock down your mortgage options before you begin house hunting. Having your financing lined up can make the process go smoother, and give you a leg up on other buyers who’ve not yet been prequalified or pre-approved for a mortgage.

Here are the general steps to getting a mortgage:

- Get a handle on your finances and credit. Add up your total monthly expenses and subtract them from your total monthly income to see how much you may be able to spend on a monthly mortgage payment. Check your credit score and report to correct any errors and take action if you need to improve your credit score.

- Get pre-approved for a mortgage. Although pre-approval doesn’t guarantee the lender will give you a mortgage, it’s a strong indication you’ll be able to qualify for one when the time comes. Having a pre-approval letter can make your offer more attractive to potential sellers.

- Comparison shop. Once you’ve had an offer accepted on the house of your dreams, it’s time to compare rates from multiple mortgage lenders. Be sure to compare all the costs of a mortgage, not just the interest rate.

- Complete the full application. You’ll need to provide detailed information about your income, savings, monthly expenses, and overall financial situation.

If you’re trying to find the right mortgage rate, consider using Credible. You can use Credible’s free online tool to easily compare multiple lenders and see prequalified rates in just a few minutes.

Have a finance-related question, but don’t know who to ask? Email The Credible Money Expert at [email protected] and your question might be answered by Credible in our Money Expert column.

Read the full article here