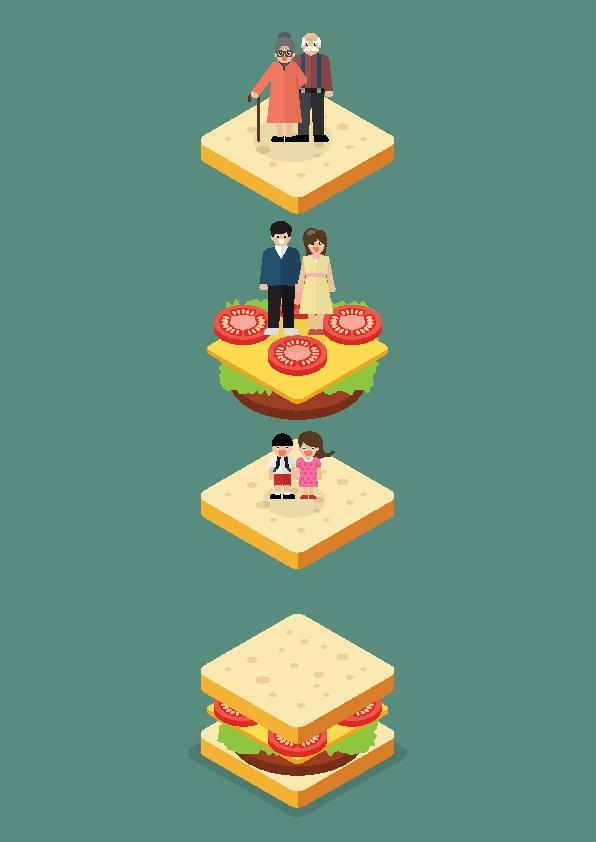

Sandwich generally means something you eat that consists of two pieces of bread with a filling between them. But in 1981, it became the name of a generation. Initially, it described a segment of the middle-aged generation (young Baby Boomers) who were caregivers, “sandwiched” between their young children and aging parents. Today, Boomers may find themselves sandwiched between their grandchildren, children, parents and, maybe even, grandparents. Sometimes, the Boomers may need caregivers, as well.

The Centers for Disease Control and Prevention reported that Baby Boomers most often cared for a parent or parent-in-law (42%). Besides all the physical, emotional and mental issues related to that care, there are many Medicare concerns that need to be addressed. In my experience, those often seem to get lost in the shuffle. But when there is a health crisis, not having addressed Medicare issues can intensify the situation.

It’s never too late to get ready. This checklist will help you fill in the gaps just in case and, if you are a Boomer, it might be good to do this for yourself, another “just-in-case.”

Social Security

Because Medicare encompasses so many Social Security issues (and vice versa), let’s start with that.

A my Social Security account.

- If there is no account in place, your parent should establish one. (Start here.)

- If there is an account, verify that access to it is through either a Login.gov or ID.me account. Social Security has been ramping up security protocols so just the username and password will no longer work.

- If Login.gov or ID.me is not in place, there is time to transition.

Up-to-date contact information.

Check that contact information (name, address, email) is current. One of the biggest roadblocks in verifying identity with Social Security is a name or address that doesn’t match the system’s records.

A Social Security representative payee.

- If you must talk with Social Security on your parent’s behalf, you need to be a representative payee. A power of attorney document won’t work.

- If there is no representative payee in place, your parent, if still in charge of affairs, can do an advance designation, listing one or two trusted individuals who can manage the benefits. If and when someone else needs to take over, Social Security will choose one from the list.

- If your parent is not able to make those decisions, a visit to Social Security will be necessary to go through the application and vetting process.

Medicare

There’s no need for information about your parents’ health and medical coverage when they are healthy and managing on their own. But when a medical crisis is wreaking havoc, you’ll need that information so you might as well get it now.

Cards for Medicare and additional Medicare coverage

- If your parent has Medicare Advantage with drug coverage included, there’s only one insurance card that has the words, “Medicare Advantage,” on it.

- If opting for Original Medicare, your parent would have a Medicare card (the red, white and blue one) and probably a card for a Part D drug plan and Medicare supplement plan (Medigap policy).

- The Medicare Advantage and Part D drug plan cards should be for the current year. Even though plans may not change, insurers issue new cards in the fall.

A Medicare authorized representative

Just as with Social Security, you need more than a POA to talk with Medicare. You must be a Medicare representative to speak to Medicare and deal with claims, appeals and grievances. Complete a form and submit it to Medicare.

A representative for Medicare plans

If you want to talk with a Medicare Advantage or drug plan representative about a billing or coverage issue, you may need to complete a form for the plan.

A system for paying the premiums

Medicare Part B, medical insurance, Medicare supplement plans, some Medicare Advantage plans, and most Part D drug plans come with monthly premiums. Failing to pay them can lead to cancelation of the coverage. Once that happens, there is often a delay in getting the coverage back in place. With Part B and Part D coverage (either a standalone plan or incorporated into an Advantage plan), there can be lifelong penalties. If the Medicare supplement is canceled, it may be necessary to pass medical underwriting to get the coverage reinstated.

Here are a few things to know about payment for each type of coverage.

Part B:

- If your parent is receiving Social Security benefits, Part B is deducted automatically.

- If not yet receiving benefits, Medicare Easy Pay is an option. Medicare automatically deducts the premiums from a checking or savings account.

Medicare Advantage and Part D plans:

- It’s also possible to have premiums for Part D drug and Medicare Advantage plans deducted from the Social Security benefits. Work that out with the plan.

- If not, set up auto-payment with the plan.

Medicare supplement plans:

There is no option for deducting these premiums from Social Security. The next best option is to arrange for automatic deductions from a checking or savings account.

As you may have noticed, the safest solution is to set up everything on auto pay. One client did not trust auto-pay, so he opted to just send payments via US Mail. The next time I heard from him two years later, his Part B had been canceled for nonpayment of premiums. He wasn’t sure exactly what happened.

Important Questions to Ask

Where does your parent keep important papers (insurance policies, trust documents)?

You don’t need to check out these documents if your parent is independent. Just know where they are. Before my father went in for major surgery, he showed me his hiding spot in the basement ceiling. I suspect as soon as he was back home, he moved them.

Is there a current list of doctors, healthcare facilities, and medications?

If there’s a hospitalization, this information will be important.

Does your parent open any mail from Social Security, Medicare and Medicare plans?

Some days, it seems as though the mailbox is filled with only junk mail. However, it’s important to dig through that for any important mailings. I have heard from children of retirees who learned that their parents’ retiree coverage was changed to a Medicare Advantage plan when they started getting bills from their doctors who were suddenly out-of-network. Every January, I get calls from those who did not pay attention during Open Enrollment. Their premiums skyrocketed or an expensive drug was no longer covered.

Is your parent prepared to handle long-term care costs?

Someone turning age 65 today has almost a 70% chance of needing long-term care services and support in their remaining years. Over half of middle-income Baby Boomers believe that Medicare will pay for their ongoing long-term care, so they believe they’re covered.

If you don’t know whether your parent has planned for these costs, this could fall on you. The average annual amount caregivers spend out-of-pocket on caregiving is $7,242. Plus, all the hours of caregiving provided by family members is worth $204,000. Maybe, it’s time to have a conversation.

I know from experience that this is not easy, but you can get through this with a plan. Arrange the steps in a logical order and check them off. Then, you will be prepared for whatever lies ahead.

Read the full article here