The House and Senate passed a bill to keep the federal government funded through early next year. This avoids a shut down and all the costs that entails. But it also leans on a set of “continuing resolutions”, which essentially tell government agencies to do what they have been. Bypassing the regular budget process this way allows policymakers to avoid tough decisions about which programs deserve more resources and which will get less. And when this happens, children are often among the biggest losers.

When Congress adopts stopgap funding measures to avoid a shutdown and provide more time for negotiations, the discretionary programs requiring annual or regular appropriations are lucky to maintain spending at “current” levels, defined as past total spending or spending per capita.

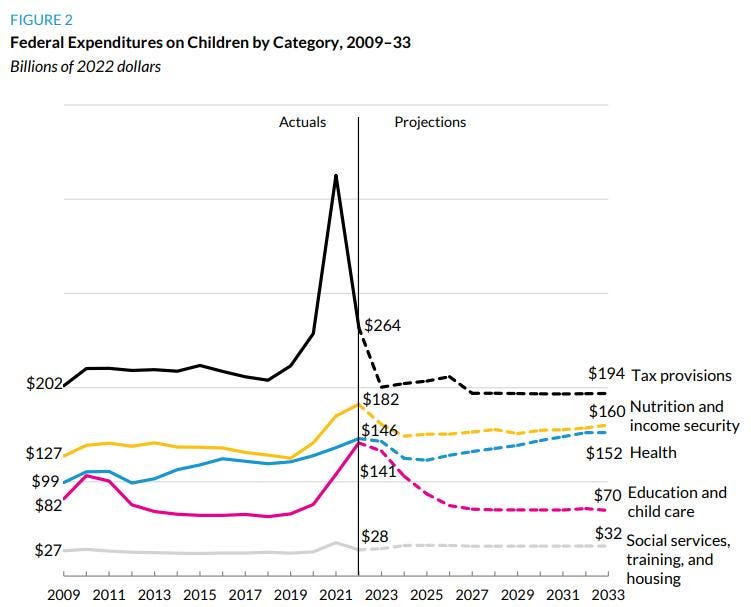

Congress might provide adjustments for inflation but not economic growth, doing little to clarify our long-term spending priorities. In the context of children, that’s important because the latest Urban Institute Kids’ Share publication shows most children’s programs are already facing stagnation and decline.

Altogether, spending on children represents about 10 percent of the federal budget. Many programs affecting kids sit within discretionary programs that don’t grow automatically over time. This includes important programs for health, education, housing, and community services.

Even within non-discretionary tax and entitlement programs that are more permanent and stable, most spending aimed at children does not grow automatically. The maximum child tax credit, the single largest child subsidy, is not even adjusted for inflation. Recently, the child tax credit shrunk after a temporary expansion in 2021 and is set to be cut in half in 2026.

Meanwhile, programs like Social Security are designed to grow along with or even faster than economic growth. As a result, children’s programs over time tend to get an ever-smaller share of national income or GDP, as well as of total government spending. Children’s health programs are perhaps the main exception, but children’s health costs are small relative to other age groups.

The result is that kids are scheduled to get an ever-smaller share of total federal spending under current law, with no significant legislative reforms on the horizon.

Allowing spending on children to decline in relative importance is a poor choice: it fails to recognize that investments in children pay off in the long run. Investments that reduce poverty and direct resources at very young children have particularly high returns—some programs can return as much as $10 for each dollar invested in children.

In a world where policy is driven by continuing resolutions and a tendency to sustain current fiscal choices, the ability to reprioritize our spending priorities becomes much less likely. And children, as they have for some time, remain losers in this status quo.

This post was developed with my Urban Institute colleague C. Eugene Steuerle.

Read the full article here