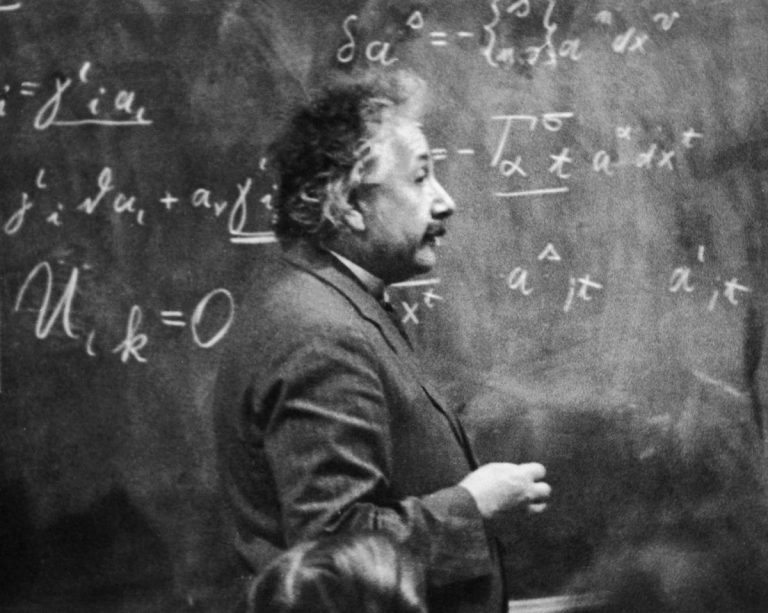

While you already may be aware of Albert Einstein and his Theory of Relativity, it’s worth a refresher before we discuss the theory of financial relativity. There’s a famous example of his theory using a train. Imagine that you are playing ping pong on a train and the train is going 60 miles per hour. The ping pong ball is going 5 miles per hour as you’re hitting it back and forth with a partner. So if you’re on the train, the ball appears to be travelling at 5 miles per hour, but if you’re an observer outside of the train, the ball would appear to be travelling at 65 miles per hour in one direction (60 mph plus 5 mph) or 55 miles per hour in the opposite direction (60 mph minus 5 mph) as speed is relative in his equation E=mc2.

The Theory of Financial Relativity

Now how does this apply to your finances, particularly as you plan for retirement? Well, your finances are relative. To start, there’s no magic number that’s perfect for everyone that means they will feel comfortable enough to retire. Saving a million dollars might feel right for one person, but may not be nearly enough for another. Your retirement number is completely relative to you, and contingent upon so many factors – the most important being what you anticipate the cost of the rest of your non-working life to be, and how long you anticipate that lasting.

The other part of financial relativity is comparison. We often get stuck in comparing ourselves to others – our friend may have retired young and perhaps did not save nearly what we feel would be necessary, but perhaps they have a large pension and are taking Social Security early. Everything is relative when it comes to finances, and you don’t truly know the full financial picture of another person either, so while it feels easy to compare yourself to others, you really can’t.

Looking Through The Train Window

Keep the theory of financial relativity in mind when you’re planning your finances, particularly your retirement. What works for someone else likely won’t work for you – and if you attempt to judge your financial situation by looking through the train window at someone else playing ping pong, it will only distort your own relativity. While this is easy to say, it can be so difficult to implement. We live in an age where social media throws everything in your face, and it’s easy to be overwhelmed by the constant spending or bragging from the people around you and to think that you’re lagging or that you’re doing something wrong. Try to keep in mind that your financial life is uniquely yours, and if possible, working with a financial advisor can give you that outside opinion that may be helpful in giving you perspective.

Financial planning and Investment advisory services offered through Diversified, LLC.

Diversified is a registered investment adviser, and the registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the SEC.

A copy of Diversified’s current written disclosure brochure which discusses, among other things, the firm’s business practices, services and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov.

Diversified, LLC does not provide tax advice and should not be relied upon for purposes of filing taxes, estimating tax liabilities or avoiding any tax or penalty imposed by law. The information provided by Diversified, LLC should not be a substitute for consulting a qualified tax advisor, accountant, or other professional concerning the application of tax law or an individual tax situation.

Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

Read the full article here