The self-employed have the potential to earn more, and build wealth faster than a traditional employee, if their business allows. If not managed correctly, though, a solo owner can also find themselves well behind retirement unless they take proper steps to save.

This reality was highlighted again with new research looking at the self-employed savings levels out of the United Kingdom. The UK, which has a public pension plan, encourages employees and business owners alike to fund their retirement. According to new research by the UK’s Institute for Fiscal Studies, only 20% of those making 10,000 pounds ($13,362) or more contribute to the pension plan on a yearly basis. On the flip side, 80% of employees making more than $13,362 contribute to the same pension plan.

The UK has it’s own unique financial realities, that result in these numbers. But it also highlights the fact that the self-employed are massively underfunding their retirement. This trend plays out in the US as well.

The self-employed manage varying level of additional costs and considerations that result in lower free cash flow that can be moved to long-term savings.

The fact you’re struggling to save as a solo owner isn’t unique. But understanding why – and how to overcome it – will help you address the fear.

Failing to account for self-employment taxes

Once you make a certain level of income, it’s about how you’re managing the income that determines if you’re able to save or not.

Every US employee has to pay for Social Security and Medicare taxes. These levies amount to 15.3% of your income. For those making more than $168,600, then they no longer have to pay towards Social Security, but they do need to continue paying 2.9% towards Medicare.

But when you’re employed, your employer pays half of the 15.3%, or 7.65%. When you’re self-employed, however, you’re both the employee and employer, which means the entire 15.3% tax falls to you. This results in far higher taxes than many expect, especially as the income begins to rise for the first time.

This portion of the tax bill is much more difficult to reduce, outside of increasing business expenses or changing your business structure.

To address it requires proactively planning for the tax throughout the course of the year, as income comes in. Using your business account or a payroll system will help with this planning. A payroll system, for instance, will allow you to take out the tax as you pay yourself.

It’s also why, if someone says they make $200,000 in revenues in self-employment, it’s not the same as making $200,000 as an employee. You have to pay for the self-employment taxes, along with operating expenses for the business.

If you don’t recognize that, it will be difficult to plan for savings within your year.

You haven’t managed your cash flow

For those new to self-employment, one of the more difficult tasks is transitioning money from a business account to the personal. Out of fear of taxes, or unable to manage personal expenses, it’s common for people to vastly underpay or overpay themselves throughout the year.

In order to effectively manage cash flows, it’s important to understand what you need on the personal side of your ledger to live.

In most service-based self-employment businesses, you’re not working out of a parent’s garage seeking a billion dollar buyout one day. But it’s still important to keep costs low on the personal side to ensure your business has what it needs to grow.

What you eventually pay yourself is the amount that covers your costs on the personal side. Then, as you begin to make more in the business, you continue to pay yourself that amount until you have enough to cover your taxes, emergency funds in the business and expenses. Only then can you begin increasing your pay, which should also include retirement savings.

Often, as revenues increase, the pull to pay yourself more grows stronger. Try to avoid this until you have the other costs you know you need to address covered.

Not Accounting for All Your Tax Benefits

One of the most important tax savings tools for the self-employed is deducting business expenses. But it’s important to remember that business expenses, when deducted, result in a cut of the taxes. It’s like getting a 24% discount in your purchases (if you’re in the 24% marginal tax bracket).

Make sure you need the business purchases – overspending to cut taxes will not prove useful long term.

As you’re tracking your business purchases, though, also make sure to account for what’s called the qualified business income (QBI) deduction.

This tax perk allows business owners to take a 20% deduction from the business income earned in a year.

It’s an impactful value, one that many service-based business owners can use to reduce their tax exposure – opening up more room to save for retirement.

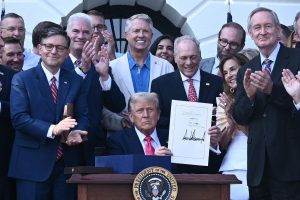

The QBI is set to sunset in 2025, unless Congress reenacts the deduction – it’s an important consideration, one that will certainly be discussed in more detail after the 2024 election.

For now, take advantage of the tax savings, so you can better save for your future.

Read the full article here